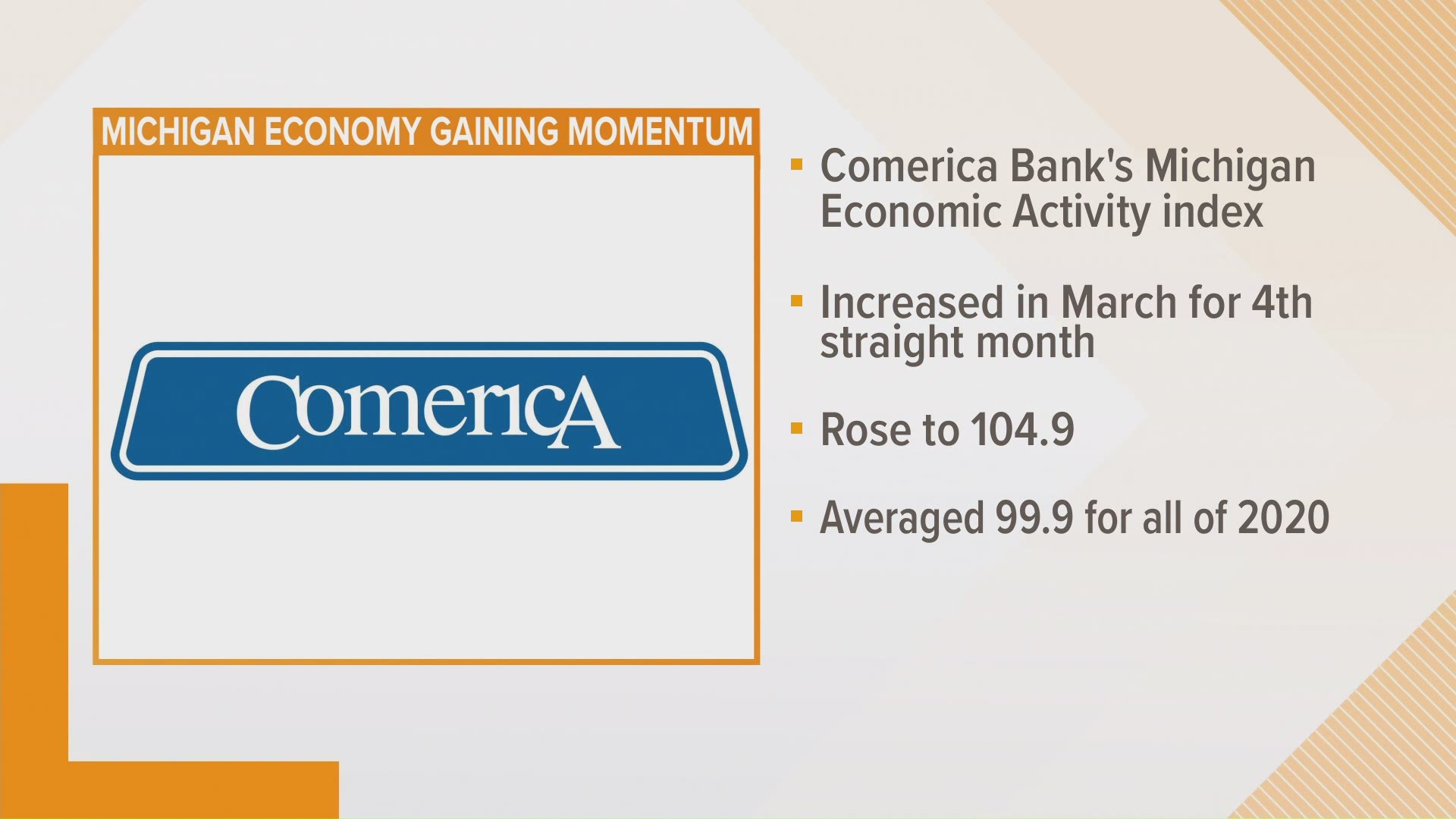

GRBJ — Comerica Bank’s Michigan Economic Activity Index increased in March for the fourth consecutive month, buoyed in part by the rollback of many COVID-19 restrictions. Comerica’s March Michigan Index rose to a level of 104.9, a reading that is 23% higher than the historical low reached in June 2020, the bank said.

The index averaged 99.9 points for all of 2020, 9.2 points below the index average for 2019. February’s index reading was revised to 104.1, up from 104.

Comerica’s Michigan Economic Activity Index consists of nine variables: nonfarm payroll employment, continuing claims for unemployment insurance, housing starts, house price index, industrial electricity sales, auto assemblies, total trade, hotel occupancy and sales tax revenue. All data are seasonally adjusted. Nominal values have been converted to constant dollar values. Index levels are expressed in terms of three-month moving averages.

Six out of nine components were positive for the month, including nonfarm payrolls, unemployment insurance claims (inverted), housing starts, house prices, industrial electricity demand and hotel occupancy.

The three negative components for March were light vehicle production, total state trade and state sales tax revenues. Those three components have a common headwind from supply-chain constrained vehicle production this spring, the bank said.

Nonetheless, the Michigan economy is gaining momentum in its service industries and in construction.

The state of Michigan in early June rolled back the majority of its COVID-related business restrictions and lifted all restrictions, including indoor gathering limits and mask requirements, on June 21 — an accelerated timeline from the original promise of July 1 as COVID-19 case numbers fell and vaccination rates rose.

Comerica said it expected bars and restaurants to staff up over the next month in anticipation of full indoor capacity this summer.

The auto sector remains vexed by supply chain constraints, with production remaining throttled and dealer inventory well below normal, the bank said. The global computer chip shortage — discussed in the Business Journal’s article on the February Michigan Index Report last month — is showing early signs of easing and may no longer be a binding constraint on production by the end of summer, Comerica said.

Production and manufacturing employment in Michigan are expected to improve through the summer, the bank said.

Robert Dye, senior vice president and chief economist for Comerica, spoke to the Business Journal in mid-June about the report.

“One of the positive things to say about this, despite the constraints on the auto sector, is the overall economy for Michigan is still lifting,” he said, “from services coming back, from consumer demand coming back, and as COVID restrictions get rolled back even more, I would expect that to continue.

“I have seen mixed and conflicting reports about supply chain issues for the auto sector and … I do still expect that global chip shortage to ease significantly by the end of summer, but it remains very much a concern.”

Dye noted with COVID-19 hitting Taiwan hard, production schedules have been disrupted yet again, which is another factor impacting the global manufacturing supply chain and in particular Michigan.

He said the housing market, though starts were in positive territory for March, also is constrained by supply issues, including pricing and availability of timber, appliances and even paint. For those who already own homes, they may see positive impacts on home equity and home values, but the news is less positive for first-time homebuyers, he said.

Moving into July and August, Dye said he expects it may be easier for restaurants and entertainment venues to increase staffing, with the impending expiration of state and federal enhanced unemployment benefits.

“There is going to be more incentive for laid-off workers to re-engage with the labor market, and I think labor numbers will reflect that,” he said. “On the other hand, I remain concerned for families with young children, because there are still lots of concerns about vaccines for children less than 12 years old — and the school situation and child care. So, this is still a very tricky environment for families with young children, especially as they consider their work options over the next few months.”

Dye said a sign to look for moving into midyear is for consumer demand for autos to remain durable, even as dealer inventory is low due to supply chain issues.

Fiscal stimulus will continue to be part of the equation, as households spend their stimulus dollars over the next several months on vacations and consumer goods, Dye said. Although it’s looking like the federal stimulus package may hit closer to the $1 trillion mark than the $2 trillion mark once it passes, Dye said this is still expected to be an “overall positive for the economy.”

This story originally appeared in the Grand Rapids Business Journal. To find similar content, pick up a copy or find more on their website.

Related video:

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter. Subscribe to our YouTube channel.