DETROIT — In order to comfortably afford a home in the United States, home shoppers will need to earn $47,000 more annually than they did in 2020, according to a new study.

The popular realty listing website Zillow released the report, claiming that home shoppers need to make $106,000 annually to afford a home. That's an 80% increase from just four years ago.

Zillow used data gathered from nationwide trending home prices and data on income gains in the United States in the study.

The data showed that home prices dramatically outpaced income gains by Americans since January 2020. In 2020, the U.S. median income was $66,000, growing to $81,000 in 2024.

By comparison, Zillow says that a typical U.S. home costs around $343,000 in 2024, a 42% increase from the cost of around $241,000 in 2020.

Zillow estimates that the average home shopper will need to earn $106,500 annually to comfortably afford a home, up over 80% from 2020 when it was estimated that a household earning $59,000 annually could comfortably afford the monthly mortgage on a typical U.S. home.

Zillow determines "comfortably afford" to mean "spending no more than 30% of its income with a 10% down payment."

Detroit, while the 14th largest market in the country, ranked relatively low among the top 50 markets when it came to the income needed to afford a mortgage.

Home buyers in that area need $75,662 in household income to be able to comfortably afford a home. But that is due in part to Detroit having one of the lowest Zillow Home Value Indexes and average monthly mortgage payments ($1,506 monthly) in the country.

"Housing costs have soared over the past four years as drastic hikes in home prices, mortgage rates and rent growth far outpaced wage gains," said Orphe Divounguy, a senior economist at Zillow. "Buyers are getting creative to make a purchase pencil out, and long-distance movers are targeting less expensive and less competitive metros. Mortgage rates easing down has helped some, but the key to improving affordability long term is to build more homes."

Michigan is currently suffering from a housing crisis, which state and local leaders are hoping to alleviate with new legislation and programs.

State representative Kristian Grant, for one, has introduced House Bill 5557.

The bill sets to change the language of the Michigan Planning Enabling Act to add housing as an interest that the planning commission needs to consider when developing plans for the future.

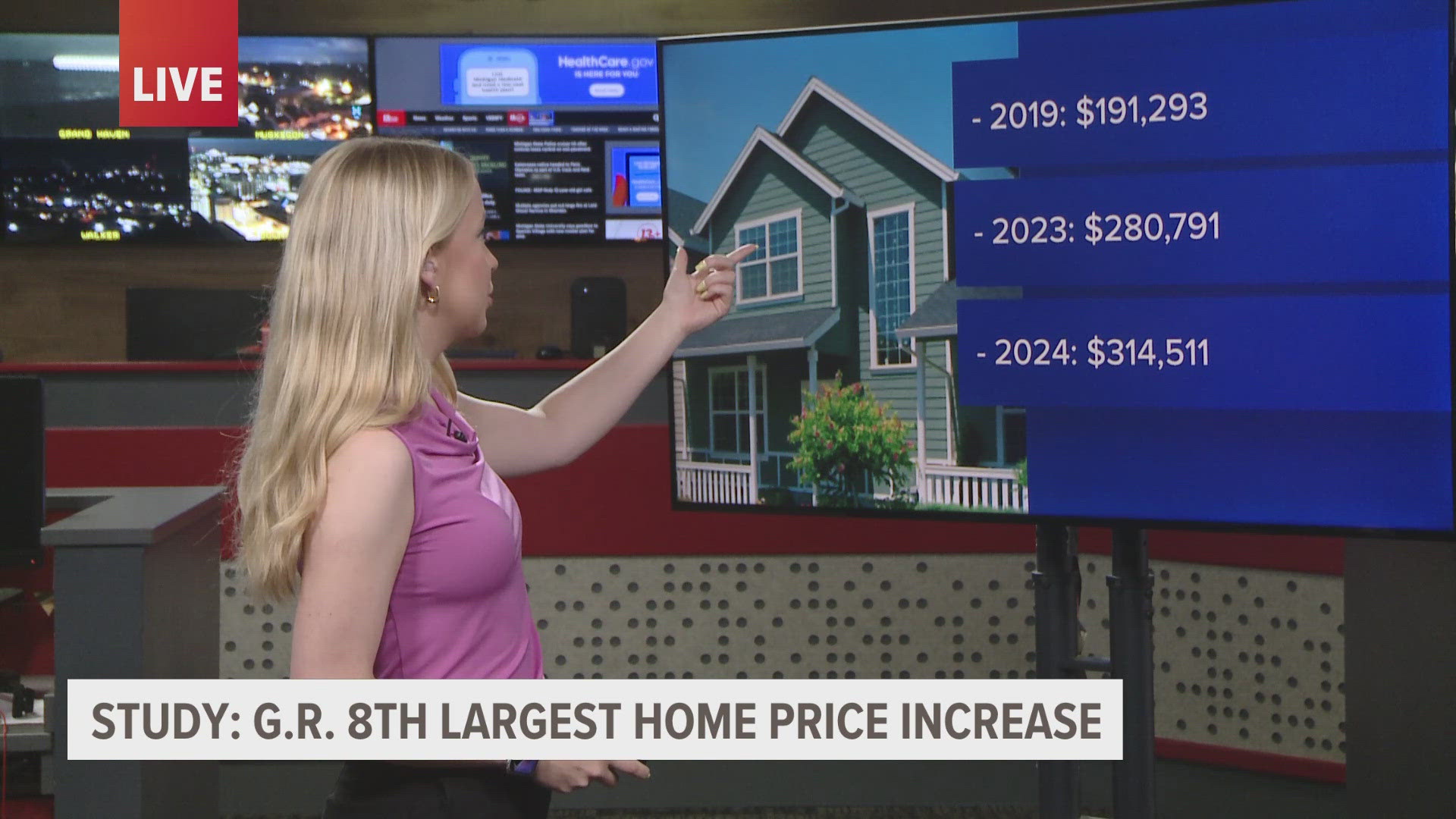

And in Grand Rapids, leaders are trying to solve the city’s issue of housing.

The city’s planning director, Kristin Turkelson, says data from an assessment conducted in 2023 showed that the city needs 14,000 new housing units before 2027 in order to stop the issue.

Legislation at the federal level is also hoping to solve the problem of rising home costs with the Downpayment Towards Equity Act, which would give up to $25,000 in grant money to first-time, first-generation homebuyers who meet certain eligibility requirements, but Congress hasn’t passed it.

To make matters worse, Zillow's study estimates that most home shoppers will need to save for somewhere between five and 19 years, depending on the market, to afford a 10% down payment on a home.

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter. Subscribe to our YouTube channel.

Watch 13 ON YOUR SIDE for free on Roku, Amazon Fire TV Stick, and on your phone.