You've heard the saying a "penny saved is a penny earned," or "time is money." Both are important when it comes to thinking about your future finances.

A penny you save or invest will make more money than one you leave in a jar on your bedside table. That same penny will earn more if you invest it for 20 years rather than just 5.

It's one of the most basic principals of interest and earnings when it comes to your money. The more time you save money, the more money you have to save.

Even if you can't invest much because you are just starting out and aren't making enough to live as comfortably as you would like, or you had a big expense recently and need to pay off some debts, saving money is still an integral part of your financial health going forward.

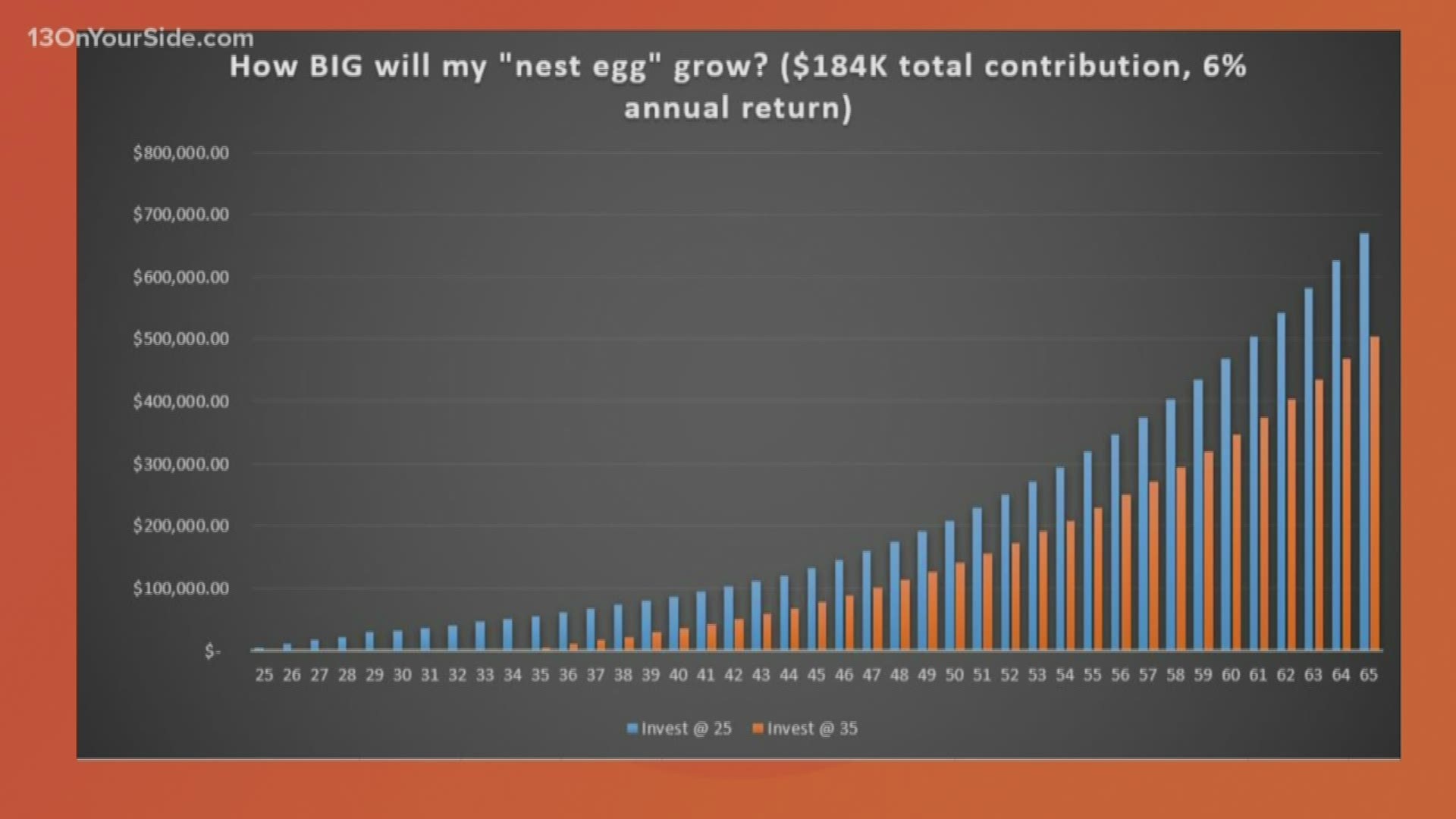

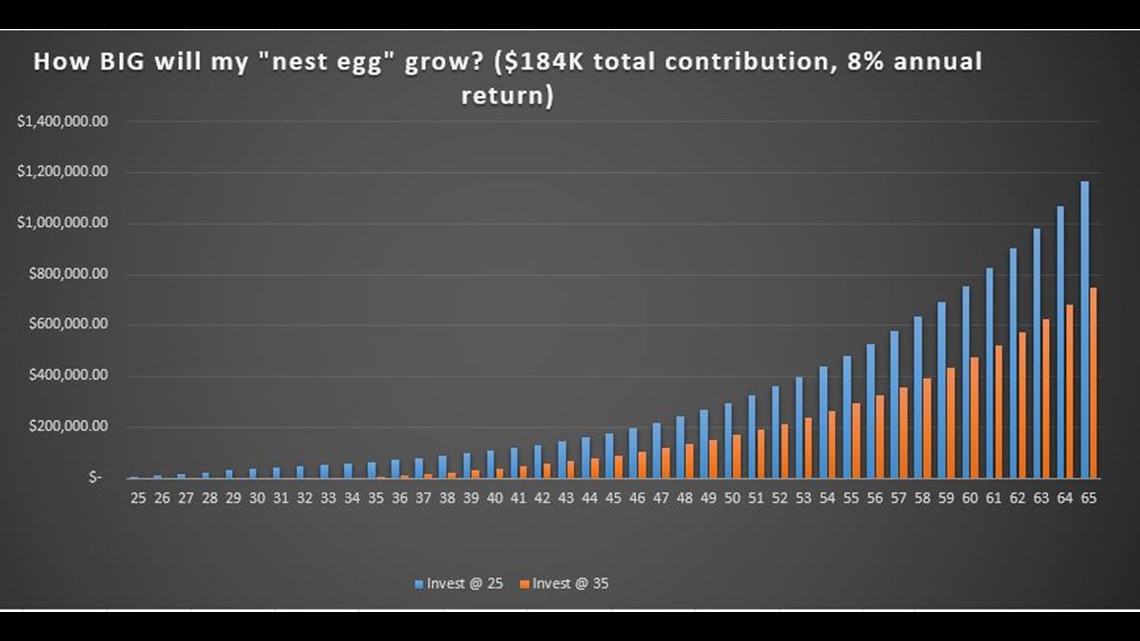

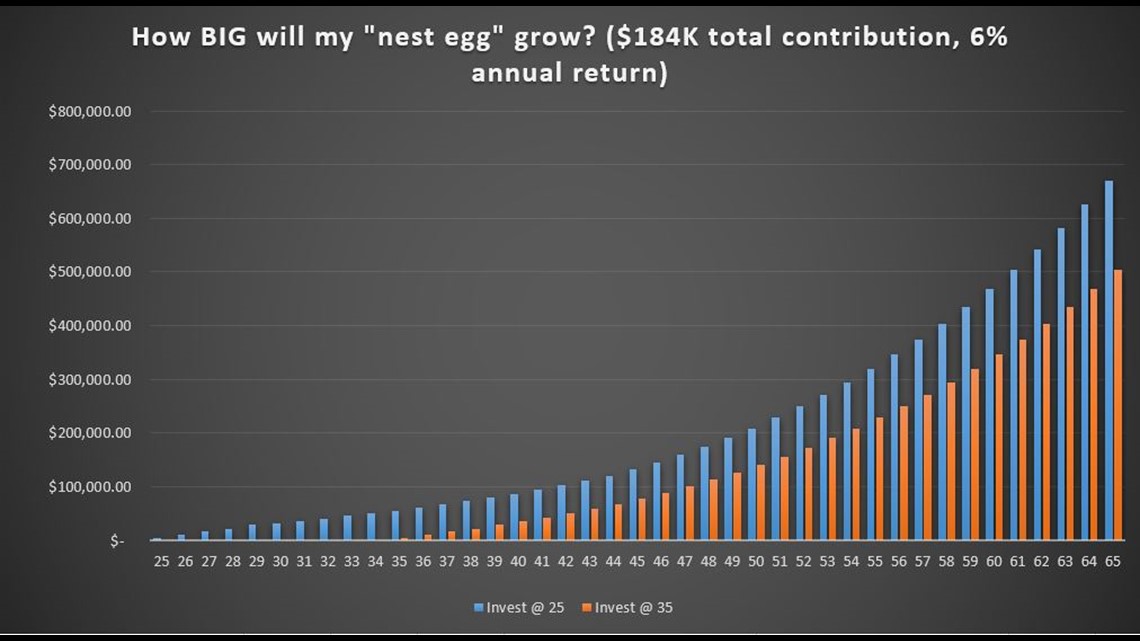

For example, if you begin saving money in a 401(k) at the age of 25 and invest a total of $184,000 over your lifetime (about $6,000 a year), you can retire with a million dollars in your accounts. If you instead wait to invest, and start at the age of 35, investing the same amount, you'll only have about $750,000 when you retire at 65. (Based on an 8% investment return) You'll have saved the same amount of money from your paychecks, but you'll have less to work with because interest isn't working as much in your favor.

If you want to use a slightly more conservative estimation for your returns, 6% is commonly used.

Now, you might not always be able to save as much as you would like, and that's okay. Starting earlier helps give you some leeway to scale things back a bit if necessary. Buying a house, starting a new job, getting married, or having kids are all major financial changes for you and can impact your ability to save. If you save a penny you could afford to save at 25, it's a penny and its accompanying interest you may not have to save when you are 35. The big thing is to still save what you can, even if it isn't much. Anything helps, especially if you are still in the beginning of your career and looking at many years before retirement.

RELATED VIDEO:

Check out some other Financial Friday's:

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter.