GRAND RAPIDS, Mich. — After the financial damage of the coronavirus crisis sets in, what does the future for small businesses look like?

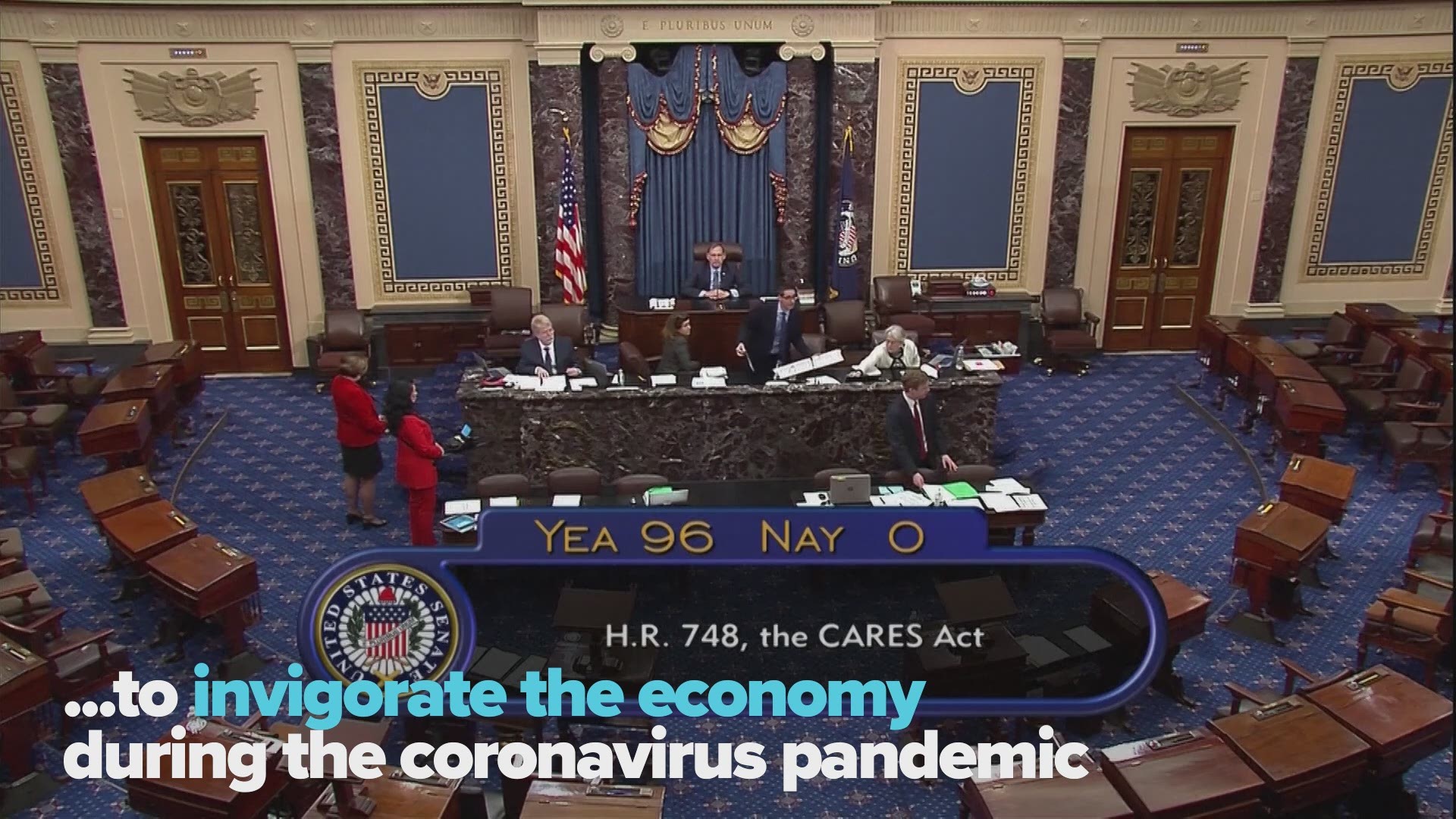

13 ON YOUR SIDE spoke to the attorneys at Mika Meyers for guidance on how small businesses can apply for the financial support they need from dedicated billions of dollars in the CARES Act, also known as the coronavirus relief bill.

“There’s a lot of money in the act to support small businesses,” says corporate attorney Michael Huff. “There’s a huge revamp of the Small Business Administration’s 7(a) loan program, which is a specialized loan program for small businesses to get money. And through the CARES Act it will be to get money for a variety of purposes beyond what is normally the case for SBA loans."

Business and real estate attorney Curtis Underwood says small businesses will also catch a break on payroll taxes.

“There are two provisions in the CARES Act that are relative to this," says Underwood. "The first, is a 50 percent refundable tax credit on wages paid to employees during the crisis, but only to certain business that qualify. They get a complete refundable tax credit which means they get to keep that money in their pocket today.”

For small business owners tying to figure out if they are considered essential and should to remain open, Attorney Underwood says its a complex thing to figure out. Employers should work with lawyers and other business support teams to determine the right move for business.

“We have complex industries where its not just a single entity or a single business, but it’s a team working together. One might be forced to shut down so the rest ask, 'are we still running?'”

During this time of crisis, the experts say economic success will depend on companies working together.

“I think overall people have been relatively flexible based on what we’ve seen," says Huff. "So it really takes a lot of groups coming together to make thing work.”

To gain more insight on small business relief, check out this article from Mike Meyers Attorneys.

More stories on 13 ON YOUR SIDE:

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter. Subscribe to our YouTube channel.