GRAND RAPIDS, Mich. — If your New Year’s resolution involves getting more fiscally responsible, 13 ON YOUR SIDE is learning more about one money-saving method gone viral. It’s called cash stuffing—and we’re breaking down how it works in this Money Guide.

“Taking back control of your personal finances, it can be life-changing for you,” said Jasmine Taylor, whose own cash stuffing video went viral.

That’s exactly what Taylor decided to do a few years ago.

“I was turning 30 and had a degree, no job, was just struggling, depressed about finances and January of that year I told myself, ‘this is my last year living this way. I’ve got to figure something out,’” said Taylor.

That “something” turned out to be cash stuffing. It’s nothing new but has recently gained popularity thanks to viral videos from online influencers like Taylor.

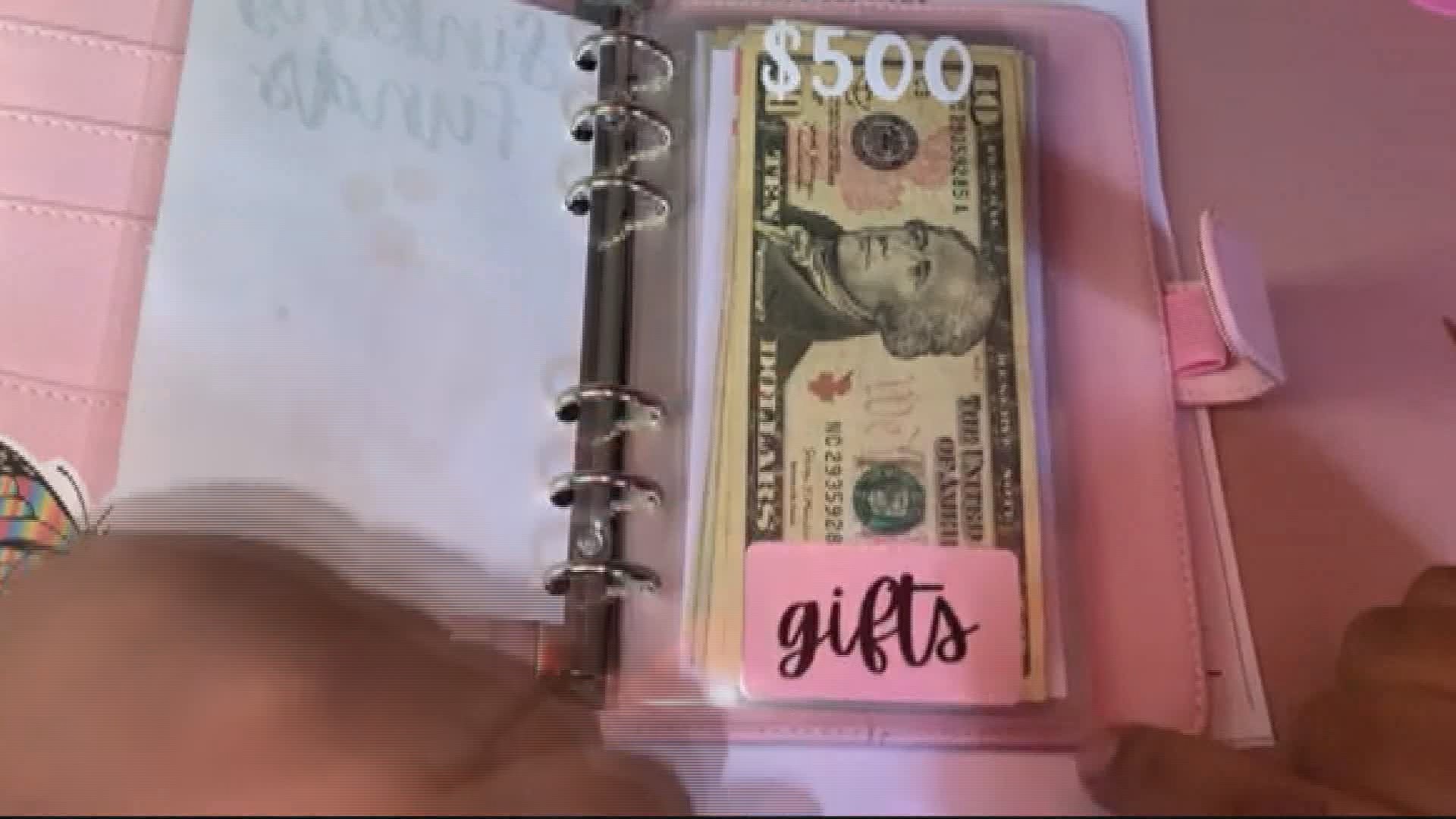

Here’s how it works: For every paycheck, subtract what’s needed for bills and then cash the rest. You then assign every remaining dollar to an envelope, each one representing the budget for your other expenses. For example, you might have one envelope for your food budget and another for gas.

Jessi Schaffner of Michigan creates YouTube videos of her own cash stuffing experience.

She said, “I’m a big fan of YouTube. I have a YouTube channel myself. So, the first thing I do whenever I want to learn something new is type into YouTube whatever the topic is.”

For some, one of the first steps can be an immediate turn-off.

“Using cash at first was really hard because I think that in this day and age people just don’t use cash,” said Schaffner.

For Taylor, she said, “It is so much easier to go inside of a store and swipe for $100 at Target versus having to actually pull a hundred dollar bill out of your wallet and break it.”

The budgeting influencer adds that “when you’re dealing with the cards, you can keep swiping and keep going until you’ve put yourself in a hole.”

Handling your money in cash, Schaffner says, can make all the difference.

“When you run out of cash, you stop spending in that category. I knew that that was something I needed – impulse control when it comes to shopping.”

It’s a method that’s been successful for Taylor. She said, “My finances have done a complete turnaround. I was never been able to save the amounts of money I’ve been able to save.”

Like with everything, there are pros and cons to cash stuffing. You can keep a closer eye on your money and exactly where it’s going. You could also be missing out of the protection and potential interest earnings that come with having certain bank accounts.

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter. Subscribe to our YouTube channel.