GRAND RAPIDS, Mich. —

With credit card debt at a record high, and recent interest rate hikes, we're paying even more to carry what debt we have. So when it comes to taking care of our credit cards, there are mistakes you should definitely try and avoid. 13 ON YOUR SIDE was joined by financial professional Kelly Gilbert from Eminence Financial to break it down for us.

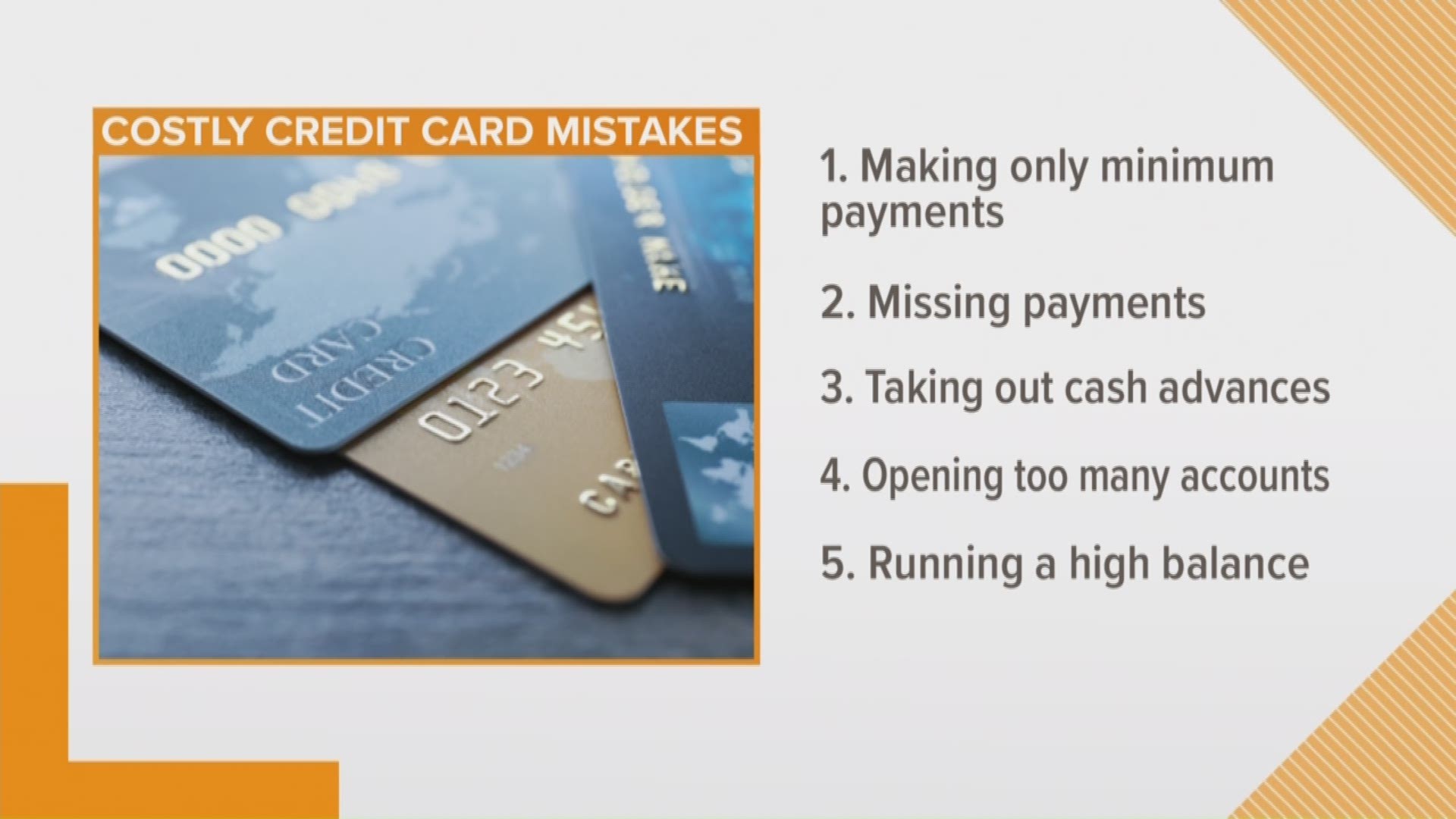

Here are the top 5 mistakes you should avoid making with your credit card.

1. Mistake: Making only the minimum payment.

Why you should avoid it:

It could take you months or even years to pay off your card if you only pay the minimum and leave the remaining balance as revolving debt. In the long run, the total cost to pay off your card will only increase due to interest. You can do the math yourself, there are online interest rate calculators.

2. Mistake: Missing payments.

Why you should avoid it:

It might seem like a small oversight, but the interest rate on the card can grow dramatically when you have late payments which can ultimately hurt your credit score. If you're overdue by more than 60 days, you will begin to experience even more negative effects. Issuers will likely report you to credit bureaus which will flag you for future loans.

3. Mistake: Taking out cash advances.

Why you should avoid it:

When you use your credit card to take out a cash at an ATM, there is no grace period which means your interest rate will accumulate right away, and that adds up quickly! Interest rates on cash advances are often much higher than the rate you pay on regular purchases. You might also face a fee from the ATM as well as cash advance fees between 2 and 5 percent.

4. Mistake: Opening too many accounts.

Why you should avoid it:

The more credit cards the more opportunities for debt. You should only have as many cards as you can count on one hand, 5. Having between 3 and 5 cards is manageable. Anything more than that can become hard to keep track of which makes it easier to be drug into a hole. In addition, if you open too many cards in a short amount of time, creditors might think you're desperate for cash and may not want to loan you money.

5. Mistake: Running a high balance.

Why you should avoid it:

Having a high balance can negatively impact your credit score. You will want to watch your credit utilization ratio. As an example, if you have a balance of $1,000 and your credit limit is $2,000, your credit utilization ratio is 50 percent. The recommendation is that you only use about 30 percent of the credit available to you. People between the ages of 55 and 64 years old have an average balance of more than $8,000. If you're a baby boomer, you'll want to be careful with how much money you are spending on high-interest debt as it might be taking away from your retirement savings.

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter.