MICHIGAN, USA — Many Viewers had questions about what the 2020 recession would mean for the upcoming tax season. So we reached out to a local CPA to try and supply some answers.

We spoke to Chris Harper, an Instructor of Accounting for Grand Valley State University at the Seidman College of Business and the Education Director for Hungerford Nichols CPAs + Consultants, about how individual forms of stimulus fit into the tax code.

Q & A With A CPA

Leona Dunn (D): Okay, so, tax questions that people are asking us. The first one being, how will filing unemployment last year affect this year's tax returns.

Chris Harper (H), CPA, MBA: Unemployment compensation is taxable at both the federal and the state of Michigan levels. So, unemployment insurance will be included. When you prepare your federal tax return. When you prepare your Michigan tax return. One good note is in Michigan, city income tax returns do not include unemployment benefits. So that's at least a little bit of a ray of hope.

D: Okay, so for those people that were getting the $900 a week due to unemployment benefits right at the beginning of March last year, that's all taxable income?

H: That is, and, you know, some people may have had tax withheld. The thing with withholding is it's voluntary. And you and I are recording this interview in early January 2021. So it's really too late to do anything about that. It's really set in stone. But for any future unemployment benefits, people could look at filing with the Michigan unemployment insurance agency, and you could have taxes withheld for future payments.

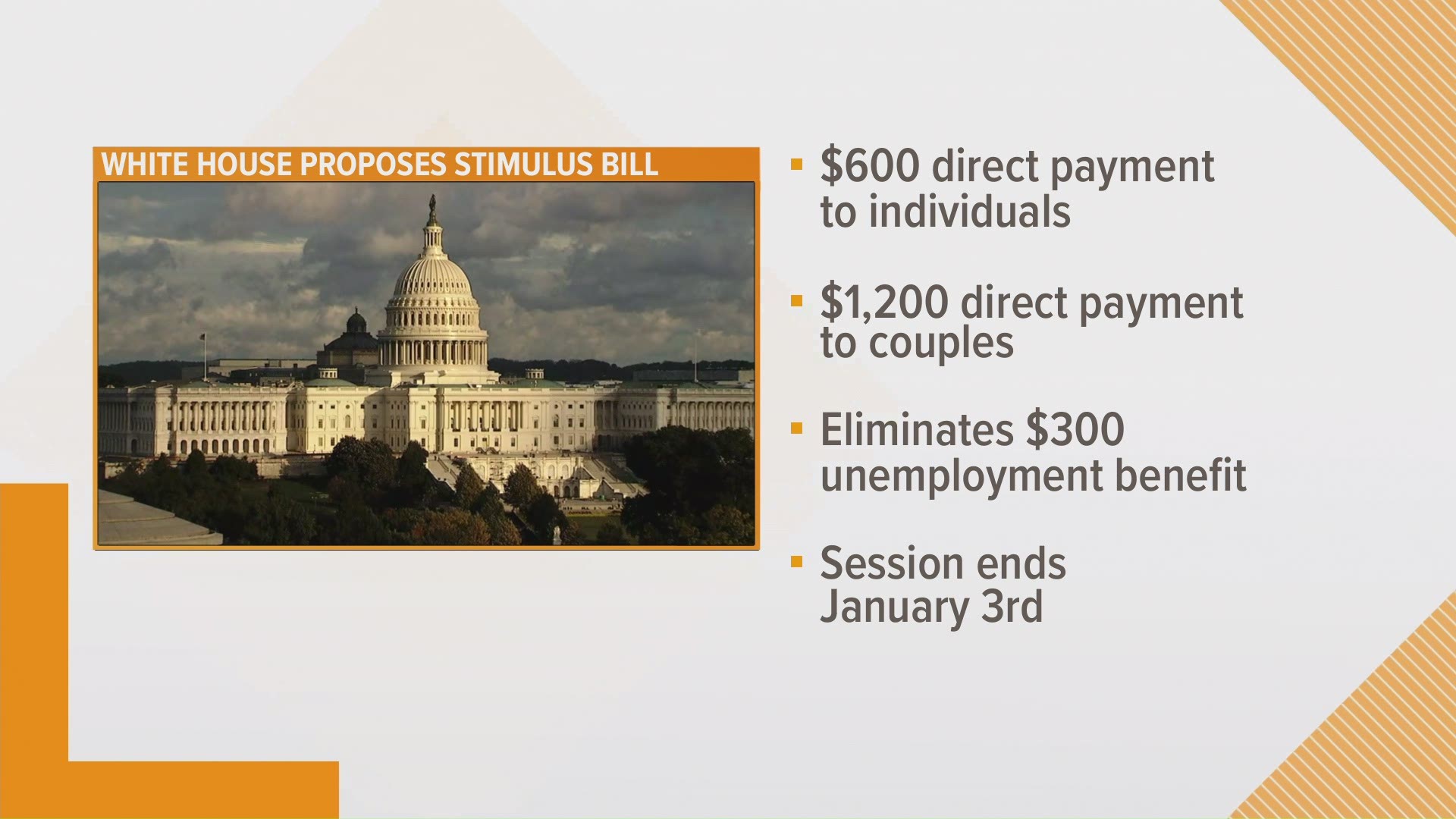

D: So, along with that, people are wondering about the other form of stimulus they got last year — those direct stimulus checks. And so, how, how does that fit in when it comes to taxes?

H: Well, the good thing about the stimulus checks is those are really an advance payment of a tax credit. Okay, what Congress wanted to do was they wanted to get those funds into the economy, as quickly as possible. So with both the first round of stimulus payments and with this second round that we're seeing here, those are advanced payments, and that is not included in your taxable income. In fact, there's a potential that when you prepare your 2020 tax return you're going to perform a reconciliation, there's going to be a worksheet that taxpayers will complete called a 'recovery rebate credit worksheet.' And you may even have some additional credit coming to you, but you're only going to know that when you prepare that worksheet.

D: Okay. And so I'm just asking like a follow up from that... If there's an additional credit, how would you find that out ?

H: Yes, I'm looking at the worksheet right now. The good news is if you're using a CPA they're going to walk you through that. If you're using one of the software packages, it should help you with that. If you are self preparing your tax return, this is a year to dig into those instructions and look for that recovery rebate credit worksheet, just to make sure that you're not leaving money on the table when you actually file your tax return. The sheet is too new to me to break down, right now.

D: Okay. And then I guess the last question I would have just is for the people that had unemployment again. If I got those extra benefits last year — the weekly $900. $600, $300 unemployment checks, I put zero for the withheld, am I going to have to pay back taxes on those, just for clarity?

H: This part of the tax calculation, it will be taxable at the federal and state level so what that means is there's a potential that if you normally would have received a refund, the refund could be smaller. Or there could even be a situation where you would owe tax. And that's really going to be on a taxpayer by taxpayer basis, and we really can't know the answer to that question until you actually prepare your tax return. You're going to receive a form, 1099-G, from the unemployment insurance agency, and that will have all the benefits that you received, and it will also have any tax withholding. And you take that with all the other love letters that you get during the month of January, W-2's and whatnot, and then we'll know the answer to that question. It could reduce a refund, it could cause you to owe, we will just have to see.

For more information on how your unemployment payments differ from your unemployment benefits, you can visit the IRS website where we linked how you can figure out if you have the right taxes being withheld.

RELATED VIDEO:

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter. Subscribe to our YouTube channel.