GRAND RAPIDS, Mich. — In honor of National Consumer Protection week, Michigan Attorney General, Dana Nessel's, office released a top 10 list of consumer complaints. The categories did not change since last year’s report, but the categorical rankings did. Four of the 10 complaint categories kept their places; half moved up one; and complaints against personal service providers dropped from two to seven in 2018.

"Nessel's Top 10 list is compiled by analyzing the nearly 9,000 written complaints filed with the Attorney General's Consumer Protection team in 2018. The department recovered more than $1.6 million in consumer refunds, forgiven debts and state recoveries in 2018," Nessel's office said.

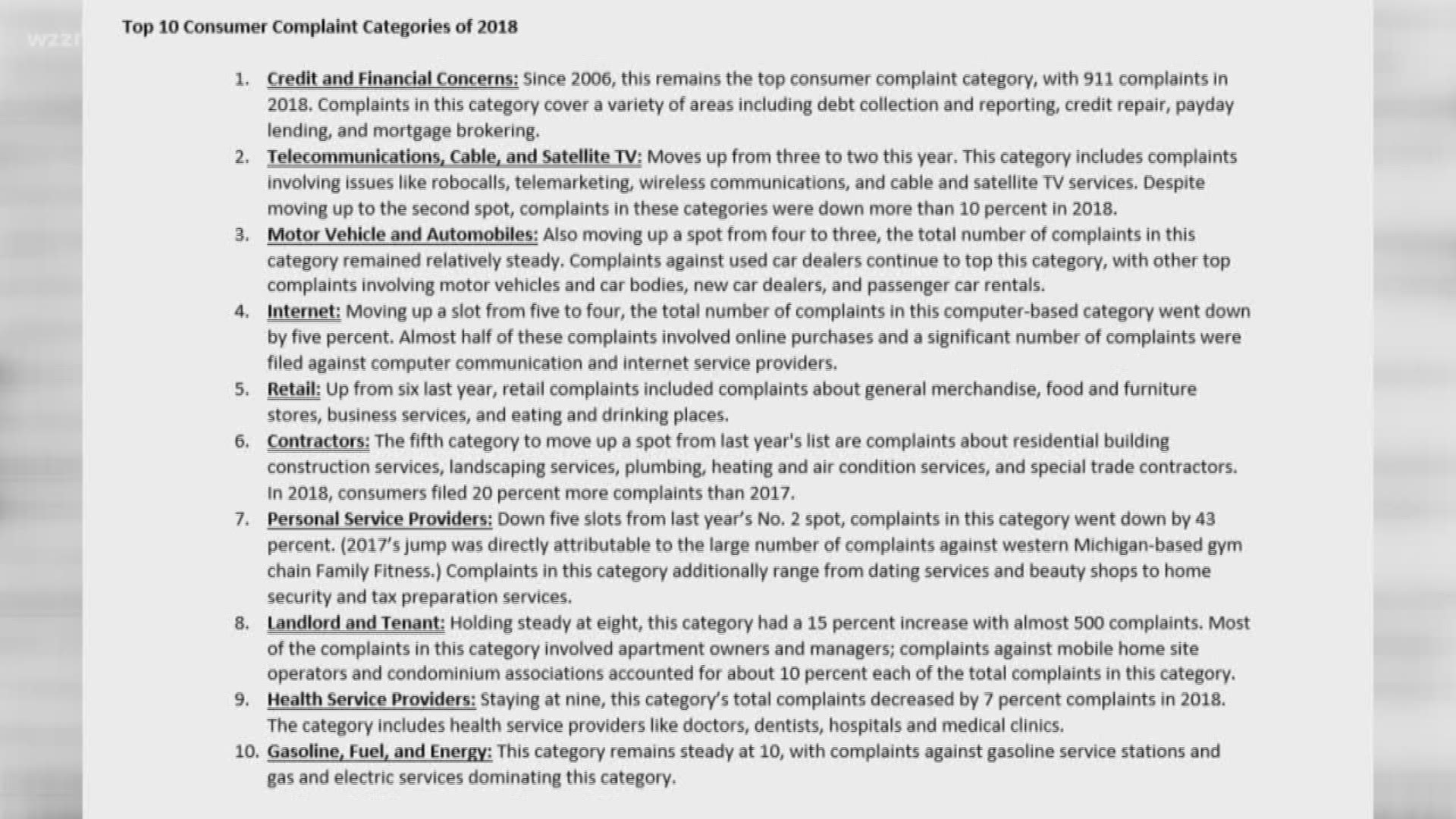

Top 10 Consumer Complaint Categories of 2018

Credit and Financial Concerns: Since 2006, this remains the top consumer complaint category, with 911 complaints in 2018. Complaints in this category cover a variety of areas including debt collection and reporting, credit repair, payday lending, and mortgage brokering.

Telecommunications, Cable and Satellite TV: Moves up from three to two this year. This category includes complaints involving issues like robocalls, telemarketing, wireless communications and cable and satellite TV services. Despite moving up to the second spot, complaints in these categories were down more than 10 percent in 2018.

Motor Vehicle and Automobiles: Also moving up a spot from four to three, the total number of complaints in this category remained relatively steady. Complaints against used car dealers continue to top this category, with other top complaints involving motor vehicles and car bodies, new car dealers and passenger car rentals.

Internet: Moving up a slot from five to four, the total number of complaints in this computer-based category went down by five percent. Almost half of these complaints involved online purchases and a significant number of complaints were filed against computer communication and internet service providers.

Retail: Up from six last year, retail complaints included complaints about general merchandise, food and furniture stores, business services and eating and drinking places.

Contractors: The fifth category to move up a spot from last year's list are complaints about residential building construction services, landscaping services, plumbing, heating and air conditioning services and special trade contractors. In 2018, consumers filed 20 percent more complaints than 2017.

Personal Service Providers: Down five slots from last year’s No. 2 spot, complaints in this category went down by 43 percent. (2017’s jump was directly attributable to the large number of complaints against western Michigan-based gym chain Family Fitness.) Complaints in this category additionally range from dating services and beauty shops to home security and tax preparation services.

Landlord and Tenant: Holding steady at eight, this category had a 15 percent increase with almost 500 complaints. Most of the complaints in this category involved apartment owners and managers; complaints against mobile home site operators and condominium associations accounted for about 10 percent each of the total complaints in this category.

Health Service Providers: Staying at nine, this category’s total complaints decreased by 7 percent complaints in 2018. The category includes health service providers like doctors, dentists, hospitals and medical clinics.

Gasoline, Fuel and Energy: This category remains steady at 10, with complaints against gasoline service stations and gas and electric services dominating this category.

Credit and financial concerns topped the list, and Alicia Force, Vice President of Lending at Lake Michigan Credit Union, says she understands.

“I think it affects everybody. No matter what you're doing if you're applying to get a home, you want to buy a car, sometimes even just to rent a home or an apartment, you need to have your credit pulled,” Force said.

A low credit score can affect the ability to get a loan or purchase items via payment plans, and can sometimes be due to credit fraud, which Force said is on the rise.

“You'll have fraudsters that go online and look for any opportunity to break into your personal information, stealing that,” she said.

Force added that there are ways to grow your credit and stay safe from scammers. Her advice is to keep an eye on all transactions through online tracking and to keep and or shred all receipts.

If your delinquent payments are a result of a hard-economic time, Force says to keep pushing forward.

“You can turn it around by continuing on time payments; maybe resolve that incident with the creditor. You can call them directly try to get that settled or paid off in full. Once you rebuild that it will help you which just will save you money, and time and energy in the future,” Force said.

Regardless of why your credit or financial state might be less than desirable, Force said the best way to get ahead is to continuously monitor your credit score.

“All Americans have the right to a free credit report per year. The government has a site: annualcreditreport.com. Once you get that you're able to see all your trades. You can see if there's anything derogatory, you can bring it into your credit union or if you bank, they could explain things to you if it doesn't really make sense to you,” Force said.

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter.