While some people found their stimulus checks deposited in their accounts or arriving in their mailboxes over the last two days, others have run into issues.

The Economic Impact Payments (EIP), better known as stimulus checks, are being issued in the amount of $600 per adult (or $1,200 for a joint return) and $600 per qualifying dependent child.

The checks officially became available Jan. 4, but the Internal Revenue Service began issuing them on Dec. 30 to meet a mid-January deadline.

In order to be eligible and receive the full amount, you had to have a Social Security Number and a 2019 adjusted gross income less than $150,000 if filing a joint return or if filing as a qualifying widow or widower; $112,500 if filing as head of household; or $75,000 for any other filing status.

The IRS re-launched its online tool to help people track their payment, but by Tuesday, many people were reporting problems.

Your payment status is 'not available'

A Muskegon family of seven likely will not receive their second stimulus check as a result of their 2019 taxes not yet being processed.

Melissa Juntunen said her and her husband have not received information as to why their taxes, which she says were filed early last year, have not been processed.

But, when she checked to see when their stimulus check would arrive, she received 'payment is not available.'

"Here we are almost having to go, you know, file again, and we have nothing," Juntunen said Tuesday.

The guidance from the IRS is to file for a credit in your 2020 taxes, which tax manager Lena Abissi says is probably the only way to access those funds.

"If you haven't received your second stimulus payment by the time you file your 2020 tax return, there will be a place on the return to claim it at that point," said Abissi, who works for Culver CPA Group in Grand Rapids.

"So, they're saying, don't try and I guess in a way, upset the applecart because the wheels have already started turning, and it'll be very difficult to try and stop things and pull your particular situation out and try and resolve it that way."

Abissi said she knows of multiple instances where people are waiting on their 2019 taxes to be processed, which she attributes to backlogs at the IRS as a result of the pandemic.

"If your situation was delayed in some way then it wouldn't be a surprise that the stimulus payment might not yet be processed and ready to go. That's just kind of been the way things have worked unfortunately," Abissi said.

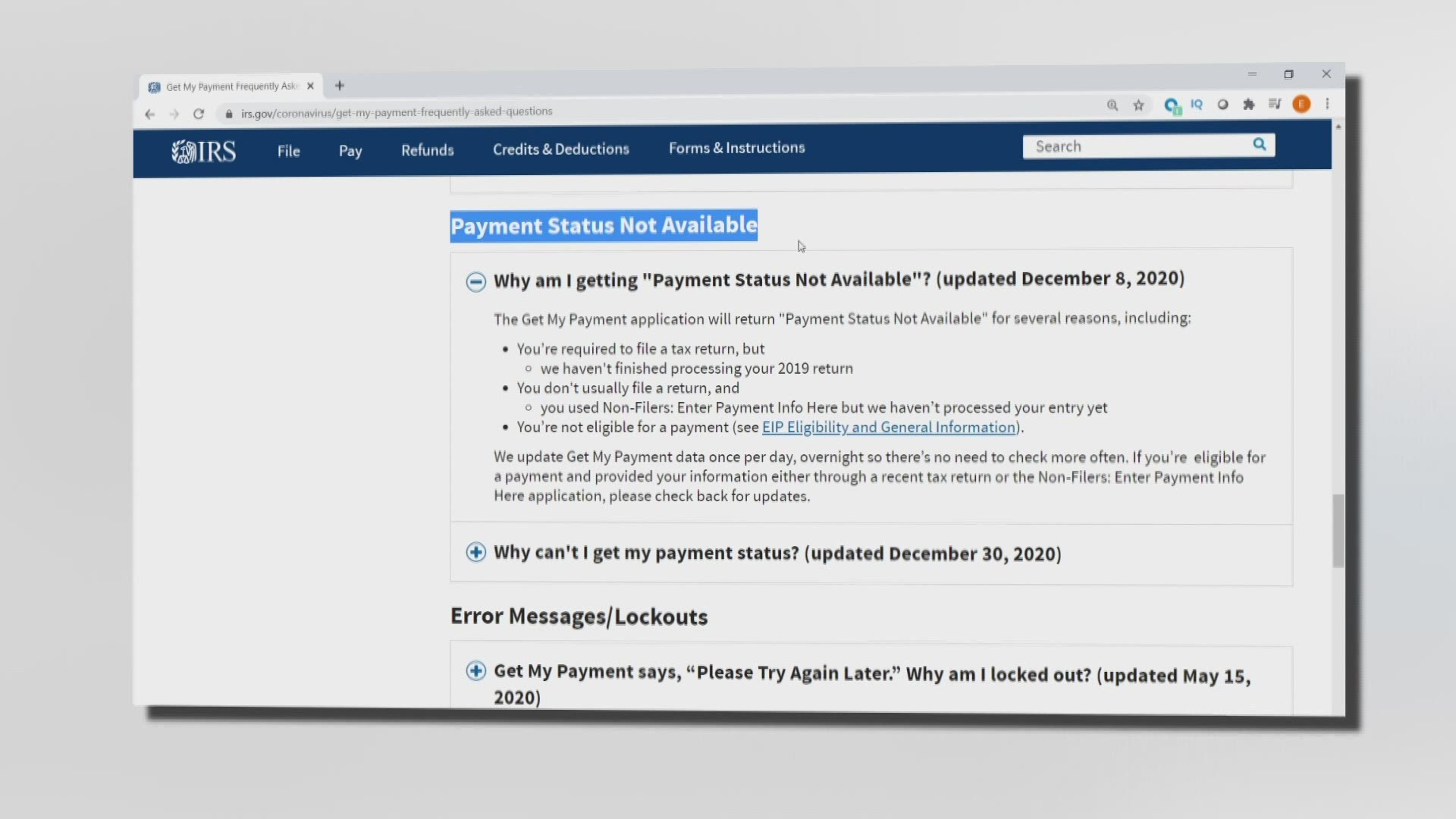

According to a December update on the IRS website, these are the reasons you may receive 'not available' when checking the IRS Get My Payment tracker.

The Get My Payment application will return "Payment Status Not Available" for several reasons, including:

- You’re required to file a tax return, but

- we haven't finished processing your 2019 return

- You don't usually file a return, and

- you used Non-Filers: Enter Payment Info Here but we haven’t processed your entry yet

- You’re not eligible for a payment (see EIP Eligibility and General Information).

- We update Get My Payment data once per day, overnight so there’s no need to check more often. If you’re eligible for a payment and provided your information either through a recent tax return or the Non-Filers: Enter Payment Info Here application, please check back for updates.

Your payment was deposited in the wrong account

Others have noticed their check being deposited in the wrong account, likely because it was deposited to their tax preparer instead of their checking account.

Tax services like H&R Block and TurboTax have confirmed that the issue is happening to their customers.

H&R Block said in a statement Tuesday:

"H&R Block understands stimulus checks are vitally important for millions of Americans. The IRS determines where second stimulus payments were sent, and in some cases, money was sent to a different account than the first stimulus payment last spring. We immediately deposited millions of stimulus payments to customers’ bank accounts and onto our Emerald Prepaid Mastercard® yesterday, and all direct deposits are being processed. If the IRS Get My Payment website displays an account number a customer doesn’t recognize, H&R Block customer service agents are ready to help with additional information at 800-HRBLOCK and @HRBlockAnswers on Twitter."

If your check was deposited in an account that has since been closed, there is no way to change it at this point.

As of Tuesday evening, the IRS said it will not be able to re-issue stimulus checks to people whose checks were deposited to the wrong account.

"Due to the compressed timeline, the IRS is unable to reissue and mail checks and instead encourages people to file their 2020 tax return electronically to claim and receive the Recovery Rebate Credit quickly as possible," reads a press release.

"These payments were issued so rapidly and even the April payments when you consider how little time they had to get the information and start getting the payments out, they actually did a pretty good job, but unfortunately there are plenty of situations where people are still waiting." Abissi says.

Checks are supposed to be sent out by Jan. 15 at the latest. According to the IRS website, if you are eligible and have not received your first or second stimulus payment or did not receive the full amount by the time you file your 2020 taxes — you should file for a rebate credit.

RELATED VIDEO: