GRAND RAPIDS, Mich. —

How are those New Year's resolutions going?

If you envisioned getting your finances in order during 2019, but don’t quite have a plan, we have you covered.

As part of 13 ON YOUR SIDE's Show Me How Week, we went to the experts for tips to create and maintain a budget.

Brenda Kading-Payne, a financial advisor with Edward Jones, has some simple steps.

Step One: Know where you are today.

“Take inventory: Get all of your loans, your debts, your bills, and kind of get those organized so you know where you're starting," Kading-Payne said. "Consider your investments, your for 401k and those sorts of things.”

This monthly budget worksheet is tool to help you tackle this step.

“When I give this to clients I tell them not to curb their spending because they're writing it down, write down what you actually spend," she said. "The perception of most folks is that they spend less than they actually do.”

Step Two: Identify your goals.

Make them specific, and think short, intermediate and long-term.

“Short term could be setting up an emergency fund, intermediate term could be child's education," she said. "And a long-term commonly is retirement planning.”

Step Three: Organize your cash.

“You can look at what you're spending on an everyday basis, you can look at what you're saving," she said. "You can look at what your emergency accounts are. And you can actually look at cash... as part of your investment portfolio.”

Step Four: Manage and organize your debt and credit.

“There is good debt there is bad debt," she said. "Good debt is often mortgages, car loans, student loans, because they put you in a better position. Bad debt would be credit card debt with really high interest rates, using other credit cards to pay credit cards.

AnnualCreditReport.com is a tool she recommends to help take on this step.

“There are three credit tracking agencies: TransUnion, Equifax and Experian, you can request a free annual report from each of those each year," she said." My suggestion would be to ladder that out. Request one in January from one organization, one in June from another and maybe one in September or October from the third."

She said the reports wont provide a credit score, but they are a helpful way to check for fraud and get your information organized.

She also suggested using credit and debit cards as tools to organize and master your debt and credit.

"Debit cards we want to make sure were using them in the right way in, but also protecting them more," she said. "A lot of places will have a app or a website or you can put on your debit card a limit and if you hit that limit say $500 you get an alert on your phone."

This is a helpful way to know if your either your debit or credit card has been compromised, she added.

"But remember. Credit card companies will go after their money a lot quicker," she said.

Step Five: Have a plan to review your plan.

“It's great to set all these things in motion, but if you don't have a strategy to come back and take a look and see what progress you're making, then the plan is likely to fall apart,” she said.

Don’t be afraid to enlist the help of an expert.

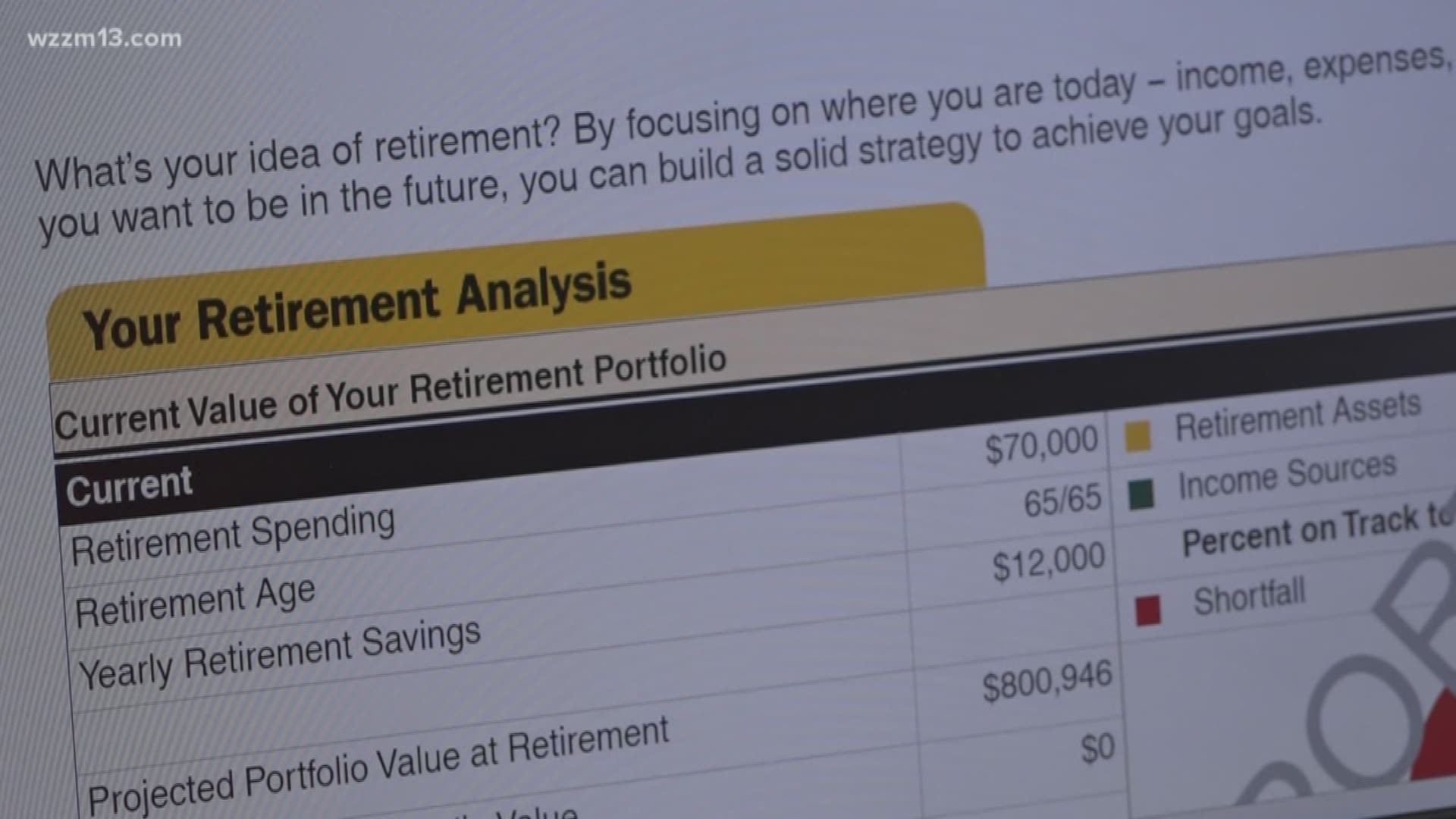

“When you meet with a financial adviser or another individual in that industry," she said. "They can plug in some of those data points that we talked about for saving, for spending, and your plan, and see where you are today and where we want to be.”

If you have a retirement plan through your work, similar projections can also be found on your employer’s online portal.

She also suggested utilizing budgeting apps, such as Mint or apps connected to your bank account, to help keep everything organized.

Apps for budgeting include:

- Gold standard in budget apps: Mint

- Syncs with your accounts to track your spending.

- For people looking to invest: Personal Capital

- Optimize your investment strategy.

- For hands-on users: You Need A Budget (YNAB)

- Find out how to live on last month’s income.

- For couples: Goodbudget

- Based on the “envelope system,” pool your money and have compartments for everything.

- Budget with savings and investment: Acorns

- Round up your purchases and invest the change.

- Simple option: PocketGuard

- Get a snapshot of what you can spend at any given moment.

- For bill paying: Prism

- Easily organize and pay your bills.

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter.