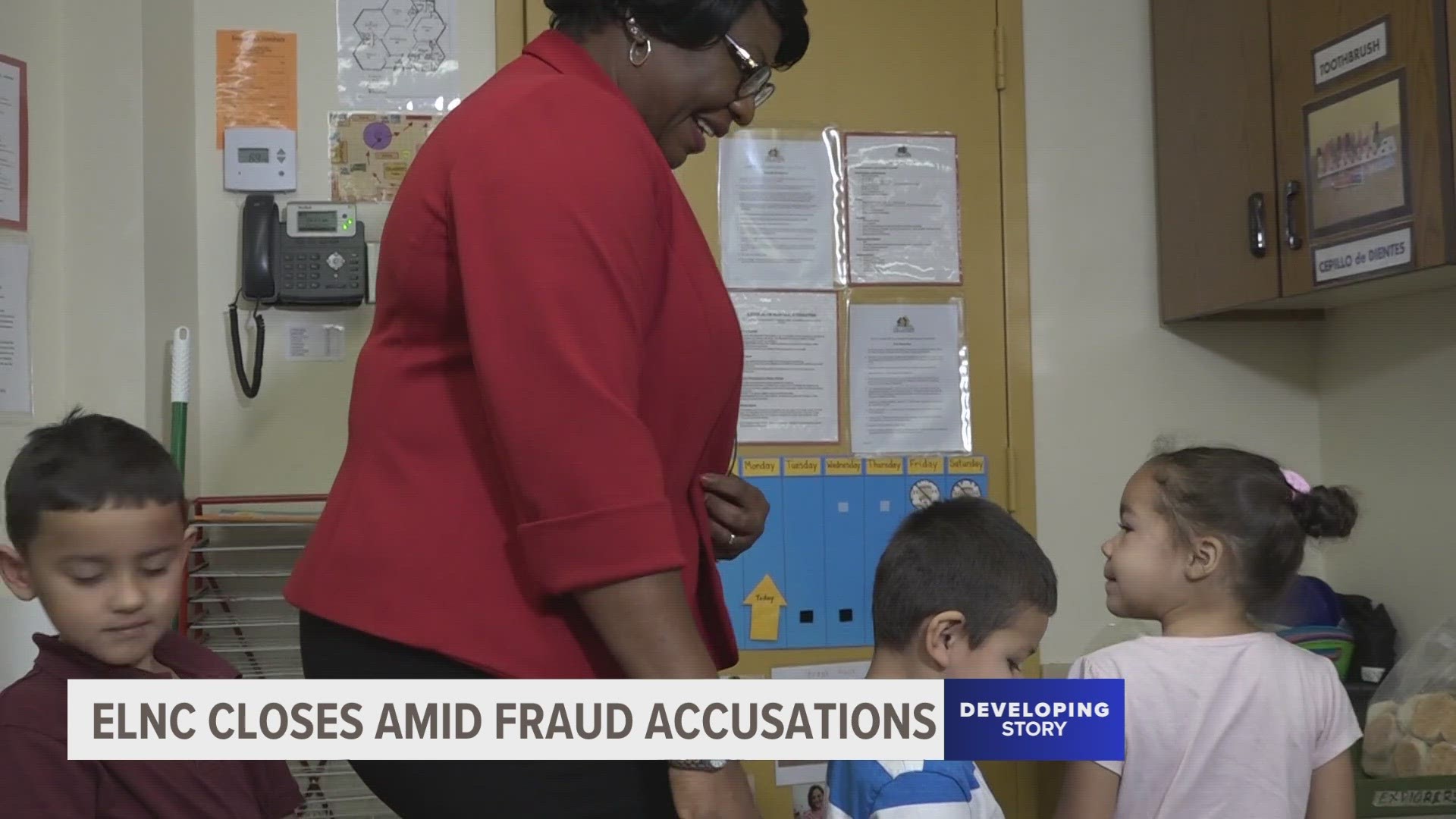

GRAND RAPIDS, Mich. — Early Learning Neighborhood Collaborative (ELNC) is closing its doors permanently after former staff members allegedly embezzled hundreds of thousands of dollars.

The Grand Rapids nonprofit announced Tuesday that they were suing its former CEO and Director of Finance and Administration for nearly $3.5 million in damages and compensation.

The lawsuit claims that ELNC founder and former CEO Dr. Nkechy Ekere Ezeh as well as former Director of Finance and Administration Sharon Killebrew stole money from the nonprofit and distributed it to themselves, family and friends.

"The investigation revealed, among other things, that Dr. Ezeh had used a web of interrelated organizations to funnel hundreds of thousands of dollars to herself, as well as to her family and friends—money that should have been used to support at-risk youth. But the wrongdoing extended far beyond Dr. Ezeh. For example, Sharon Killebrew, who handled ELNC’s bookkeeping, paid herself nearly $1,000,000 between June 2017 to April 2023 without ELNC Board’s knowledge," the court document reads.

ELNC's attorney, Brian Lennon, issued a statement Wednesday claiming that the non-profit's board has identified hundreds of thousands of additional dollars that were missing since the lawsuit was initially filed last week.

Lennon goes on to say that some of these funds were transferred to a business in Georgia that has ties to Nigeria. The statement also claims that Dr. Ezeh has since left the United States and is in Nigeria for "an errand."

"Their greed means 30 dedicated team members are now out of a job. Their greed caused ELNC to suddenly and permanently close our doors. Their greed has jeopardized programming for children and families in West Michigan who depend on the early care and education programs ELNC funds. We hope our education partners will be able to find money to continue to provide these critical programs," Lennon said in a statement.

ELNC Board Chair Amy DeLeeuw also shared a statement on the alleged embezzlement saying that the board has tried for months to try to stay open, but ultimately the "fraud runs too deep for the organization to recover."

"When the executive leadership of an organization conspires together to defraud an organization, the standard checks and balances and financial policies are a moot point. The founder and CEO of an organization should safeguard its finances, not divert them for her own use and that of her family. The person who could have stopped the fraud – the director of finance – was actually the person who enabled it," DeLeeuw wrote in her statement.

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter. Subscribe to our YouTube channel.