NEWAYGO COUNTY, Mich. — Jason McKinley typically spends his days overseeing construction projects. He’s the owner of McKinley Masonry and Concrete, a business started by his uncle in 1971, which he took over in 2012.

“We do mostly concrete,” McKinley said. “We do a mix of commercial and residential, but we mainly work with specific builders and specific general contractors.”

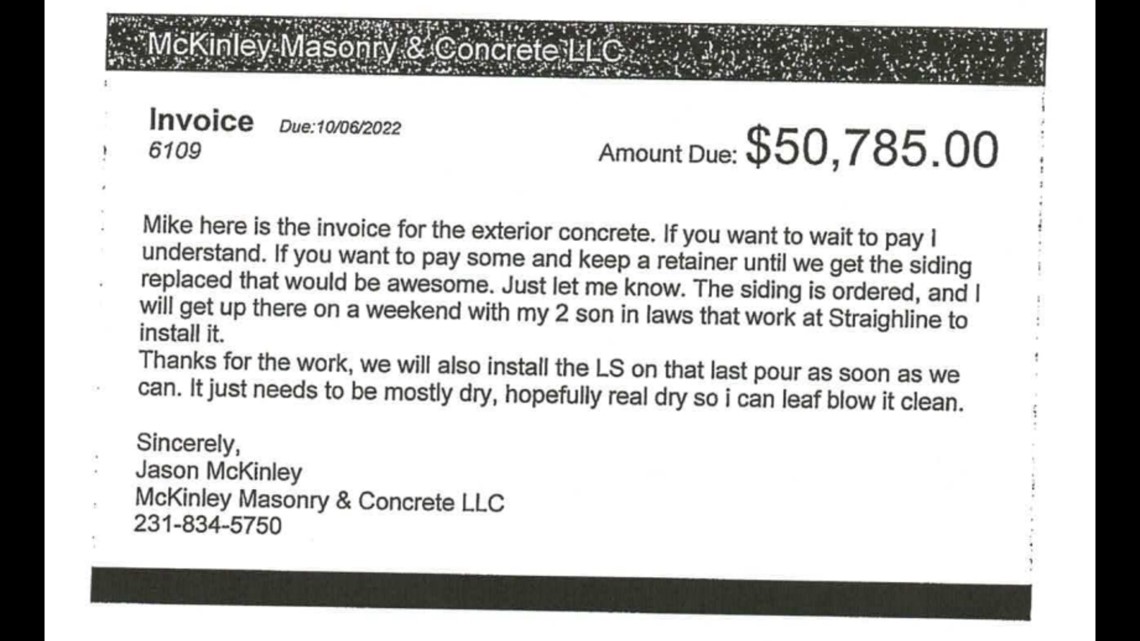

Recently though, his days have been consumed by an investigation. McKinley said he’s trying to track down $40,000 that should have been deposited into his account last fall. The money was coming from Mike Krum, who hired McKinley for a job involving exterior concrete. The total for the project was $50,785.

“One of my employees had damaged some siding on the building,” McKinley said. “So when I invoiced the customer, I told them ‘listen, I'm ordering new siding. We're going to replace your siding. Here's the invoice just so you know how much it is, and if you don't pay, I completely understand. If you want to give us something, we appreciate it.’ Obviously, we’ve got to pay for materials.”

McKinley said he was never worried about getting the full payment from Krum, because the two have worked together before. Krum agreed, saying they’ve always had a good relationship.

“So Jason sent us an invoice,” Krum said. “Out of the $50,000, we were going to pay $40,000 and then hold back 10 until everything was finished.”

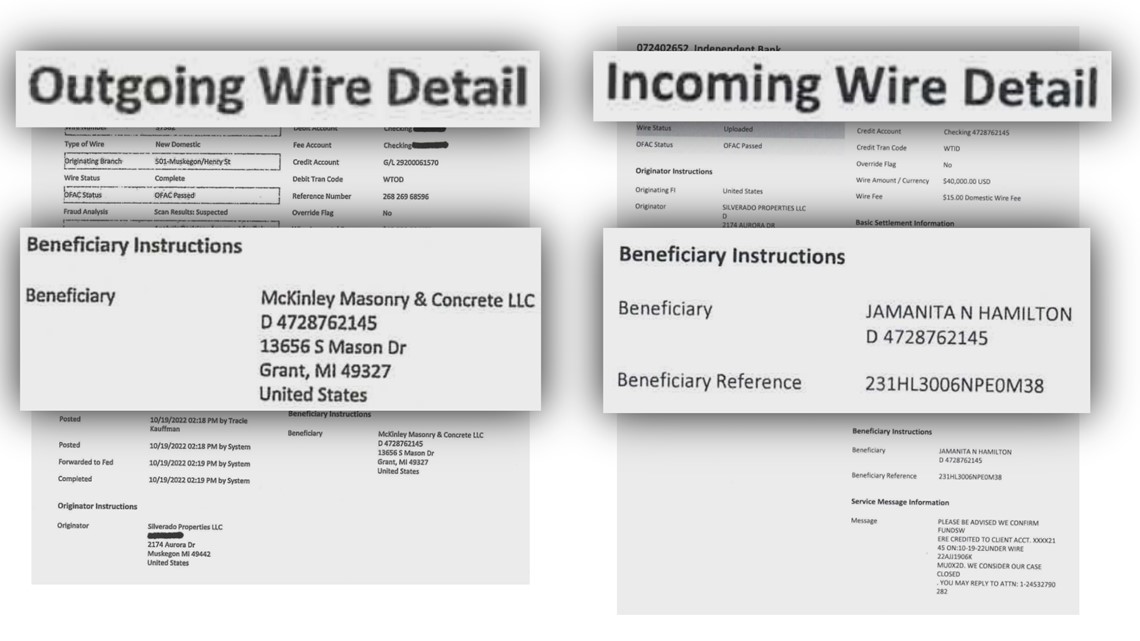

Krum said he sent the $40,000 through a wire transfer, then waited for the project to be complete before paying the rest.

“When Jason finally finished the project, and I was up there with him when he did, he asked about getting paid for it, and I said ‘yeah, no problem. We'll get you paid,’” Krum said. “So I sent him the remainder of what we thought. Then, he was going by the shop and stopped in and said ‘hey, what do I have to do to get the rest of that?’ I’m like ‘the rest of that? I paid you months ago.’”

McKinley said he never received the $40,000. That’s when they started investigating, only to find out McKinley’s email had been hacked and the invoice had been intercepted months earlier.

“They had set up a filter so that when [Krum] sent emails to me, I would never see the email,” McKinley said. “They were communicating back and forth, and the hackers were I would almost say forcibly wanting him to wire money.”

“A follow up email came looking for when we could pay and how much,” Krum said. “I thought, you know, it's probably just computer generated. Once he starts an invoice, it's probably automated and just keeps kicking these things out. They’re trying to get their money quicker, like everybody's trying to do. So I didn't think anything of it.”

Details of the incoming wire provided by PNC Bank list the beneficiary as Jamanita N. Hamilton. Both McKinley and Krum said they’ve never heard that name before, and they’re shocked this wasn’t a red flag for the workers at PNC Bank who allowed the wire transfer to be complete.

“I don't know how this person was able to set up an account at PNC with all of Jason's information and get a wire to them,” Krum said. “I don't know how that happens.”

“I really believe that somewhere in PNC there's a mole or something,” McKinley said. “Because to have the names not match and let that money go through, there's an issue going on and it should never happen.”

McKinley said he had to lay off five employees to make up for the loss. He and Krum are now working together to make others aware of the risks involved when wiring money.

“I just want people to understand that when you send a wire, you know, make sure you've got communication with the person you believe you're sending it to,” McKinley said. “Wires are the safest way to send money supposedly. And they are, if both banks are on the same page, but when one bank lets something go, then your money is just gone.”

The 13 HELP TEAM reached out to PNC Bank about this, but they told us they are not able to comment on the matter. McKinley has filed a report with the FBI, but he said there are currently no updates.

Jay and Charlie may be the faces of the HELP Team, but there are more members behind the scenes working to get the job done. HELP Team stories can be seen on weekdays at 6 a.m. and 6 p.m. and at www.13HelpTeam.com. People are encouraged to contact the HELP Team by calling 616-559-1313 and leaving a message or emailing help@13onyourside.com.

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter. Subscribe to our YouTube channel.