KALAMAZOO, Mich. — Pamela Burpee is someone who values her independence and takes pride in the space she calls home.

The 58-year-old was born with a disability called arthrogryposis multiplex congenita (AMC). The rare congenital disorder affects the structure of her joints and muscles — she’s had to use a wheelchair her whole life because of it.

“But my disability doesn't define me,” Burpee said. “It's simply a characteristic of who I am.”

She also wouldn’t let it hold her back from maintaining employment either. Burpee said she’s worked since she was the age of 16.

She used to be able to drive, but that stopped in 2019 after she became a double-amputee due to a rare bone infection known as osteomyelitis. Even though it’s been almost five years since it happened, it still takes some getting used to.

“So I am now a person with a disability who has to learn how to be a person with a disability again,” she said.

After a back injury in 1996, Burpee applied for Social Security Disability Insurance (SSDI). A year later, she was approved.

Burpee was still able to work part-time as she collected benefits, and she continually reported her earnings.

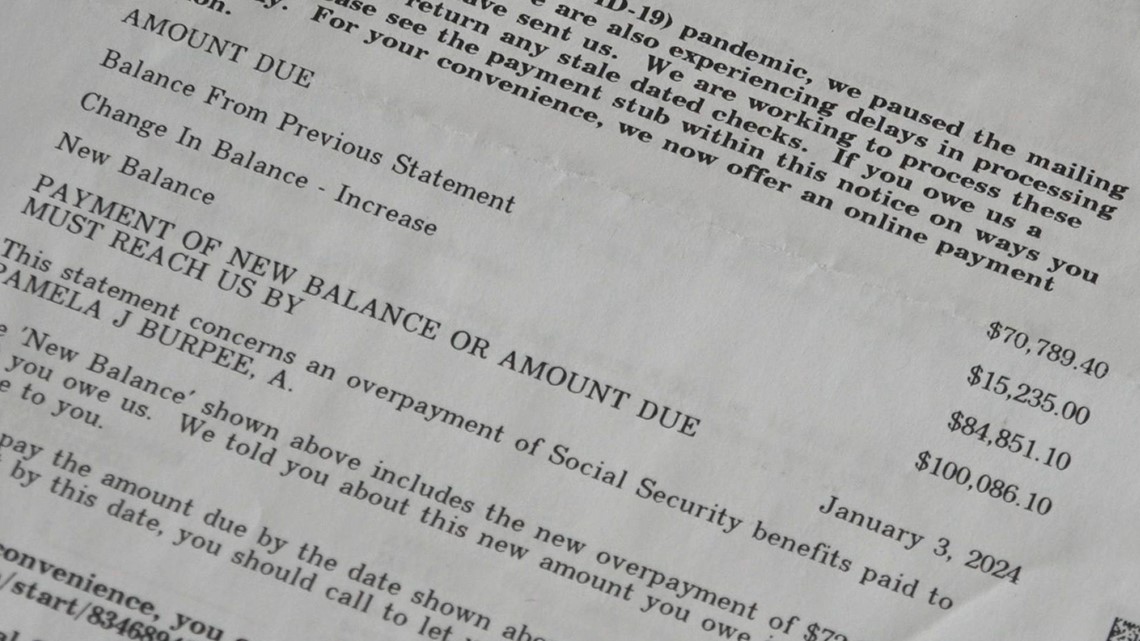

Though it never made complete sense to her, Burpee said overpayment issues were a reoccurring problem. She explained that the debt generally fluctuated around the $15,000 mark in years past, but changes were made to correct the problem — the administration would take $100 from her monthly payments.

But in October 2023, she got a letter from the SSA. The overpayment had skyrocketed by more than 550%.

“I had arrangements with Social Security Administration, for them to deduct $100 out of that monthly amount to it to pay back that $15,000. I had those arrangements, and then all of a sudden, it's just — they've recalculated everything,” Burpee said. “That's when they decided that I owed over $100,000.”

Since October, the payments she has have stopped. Burpee does work part-time as an instructor at Western Michigan University, but it’s not enough to sustain herself.

“I've had to borrow from family in order to make a house payment because I'm not willing to lose my home — I'm not willing to sell my comfort zone — I shouldn't have to,” she said. “And I shouldn't have to borrow from family in order to survive just because of their miscalculations.”

Burpee contested the overpayment. She was eventually told her benefits would be reinstated, but that it could take 120 days. She also never got any clarity if her $100,000 debt was accurate, or how it would be affected, she said.

Despite her cheerful outlook on life, she said finding the bright side can be tough.

“I try very hard on a daily basis to stay positive — that everything's going to work out,” Burpee said. “I write inspirational pieces and post them on Facebook for friends and family, because that's something that I do for my mental health — but at the end of the day, I go in my room — people don't see the tears that I cry, because I'm scared.

“I'm scared. And I don't want to have to rely on my family — that's not how I was raised — I was raised to be a fighter, and to fight for not only myself, but for those that cannot fight and don't have a voice. And I have a very loud voice. And I want it to be heard, it needs to be heard that there is a problem, and it needs to be fixed.”

What we’ve done so far

On Jan. 16, the 13 HELP Team shared Burpee’s situation with the Social Security Administration’s Chicago Region.

Two days later, we received the following response from the SSA’s regional communications director Doug Nguyen:

“Please see our blog Learn about Overpayments and Our Process | SSA and our Press Release | Press Office | SSA announcing a comprehensive review of our overpayment policies and procedures.

Our payment accuracy rates are high, although overpayments can occur given the number of people we serve, the frequent changes in their circumstances, and the statutory complexity of the programs. Regarding the Social Security program itself, which includes payment to retirees, surviving spouses, and disabled workers, only one half of one percent of paid amounts are overpayments – an extremely low percentage.

Getting an overpayment notice can be unsettling and we work with people to navigate the process. We inform people about the fact and amount of the overpayment, their right to appeal, and the options to repay or, in some cases, receive waivers of the debt.

People have the right to appeal the overpayment decision or the amount. They can also ask Social Security to waive collection of the overpayment, if they believe it was not their fault and can’t afford to pay it back. We do not pursue recoveries while an initial appeal or waiver is pending. We examine each waiver request to determine, among other factors, if the person caused the debt and their ability to repay. Even if they do not want to appeal or request a waiver, the notice says to contact us if the planned withholding would cause hardship. We have flexible repayment options—including repayment of as low as $10 per month. Each person’s situation is unique, and we handle overpayments on a case-by-case basis.

We are unable to discuss individual cases due to privacy laws.”

Burpee later told us someone from the office’s public relations department ended up contacting her and said they would look into her situation and expedite her reinstatement.

The result? Helped. (But with more work to be done.)

On Tuesday, Jan. 23, we contacted Burpee to see if there were any updates ahead of the airing of this story. During our phone call, she checked her bank account, and to her surprise, she had been paid that very day.

“I’ll be damned,” she said. Burpee had received all of her monthly payments going back to October 2023.

The case of her $100,000 debt is a different story. She said she still hasn’t been told what will become of it.

But as an advocate for those with disabilities, she said the work is far from over. Burpee said the process of working with the Social Security Administration is complicated, lacks clear communication, and is riddled with long wait times. She believes leaders should work to systematically change it all.

“We need them to do it and help us — help us to live comfortably,” she said. “I don't mean in luxury. I just want to wake up one morning and not be scared to death — that would be a big thing.”

The response from lawmakers

The 13 HELP Team contacted a number of elected leaders from the House of Representatives and Senate regarding these issues. We gave them until the end of the week to respond. Our focus was those within the state of Michigan, but did reach out to others too.

Out of everyone, Florida Senator Rick Scott’s team was the first to respond with a comment. We contacted him because in November 2023, he sent a letter to Kilolo Kijakazi, Acting Commissioner of the Social Security Administration.

Senator Rick Scott – (R-FL)

“The lack of transparency, accuracy and information from the administration is alarming and unacceptable. Millions of Americans depend on Social Security to provide accurate information and payments, and live payment to payment. If this is a problem affecting more than 2 million people, the Acting Commissioner should be making this a top priority to ensure every single payment is accurate and they are actively working with those affected to ensure innocent people are not harmed by the agency’s mistakes.”

Scott’s press secretary also included the response he got from Kijakazi:

Senator Gary Peters (D-MI)

“People rely on Social Security benefits to afford health care, groceries, and a roof over their head. I’ve heard from too many people across our state who have faced similar issues with benefit overpayments, and my office is in contact with the agency and doing everything we can to help them resolve their cases as quickly as possible. I urge anyone who has experienced these issues to reach out to my office for help, and I’ll keep working to ensure every Michigander can access their benefits without difficulty or undue harm.”

Rep. Dan Kildee – (D-MI)

“I am deeply concerned about the effect overpayments are having on Michiganders. Congress must do more to equip the Social Security Administration with the resources it needs to avoid these unacceptable mistakes. As a member of the House Ways and Means Subcommittee on Social Security, I will continue to fight to ensure our Social Security system delivers Michiganders the benefits they have earned and deserve. Any Michigander having an issue with their Social Security benefits should reach out to my office for assistance.”

Rep. Hillary Scholten – (D-MI)

“While we cannot speak directly about any pending cases in our office, we are aware of this issue and are deeply concerned. Anyone with what they believe to be incorrect outstanding balances with the SSA should contact my West Michigan office for assistance. We are here to help.”

Rep. John Moolenaar – (R-MI)

“The overpayment errors made by the Social Security Administration are unacceptable and the SSA must do more to be responsive to the Michigan seniors who have been hurt through no fault of their own. Michiganders should be able to trust the payments they receive are accurate and never have to worry about receiving a notice ordering them to repay tens of thousands of dollars. My team and I are here to help constituents who are experiencing any issue with the SSA. I encourage them to contact my office at (616) 528-7100.”

What is the difference between SSDI and SSI?

According to the National Council on Aging, SSI determination is based on an individual’s age, disability, as well as what income and resources they have. In contrast, SSDI determinations are based on a person’s disability and their work credits.

Jay and Trevier may be the face of the HELP TEAM, but there are more members behind the scenes working to get the job done. HELP TEAM stories can be seen on weekdays at 6 a.m. and 6 p.m. and at www.13HelpTeam.com. People are encouraged to contact the HELP TEAM by calling 616-559-1313 and leaving a message or emailing help@13onyourside.com.

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter. Subscribe to our YouTube channel.

Watch 13 ON YOUR SIDE for free on Roku, Amazon Fire TV Stick, and on your phone.