GRAND RAPIDS, Mich. — On the heels of some of the hottest inflation data in decades comes even hotter data measuring housing and rental prices.

In Grand Rapids, like other major cities, a supply crunch is paving the way for a housing crisis.

“[There is] significantly more competition for homes…and that's really pushed prices up,” said Ryan Kilpatrick with heads-up local advocacy organization Housing Next.

And that’s not just an inflation issue. It’s a supply problem.

“Since 2006, we haven't been built nearly enough additional housing to support the growth in population,” Kilpatrick explained. “Whenever that happens, prices go up.”

Housing Next works with local governments and developers to create housing at all price points.

“Our mission is really to understand the data for West Michigan,” Kilpatrick said.

The organization’s new numbers show the buying’s happening faster than the building.

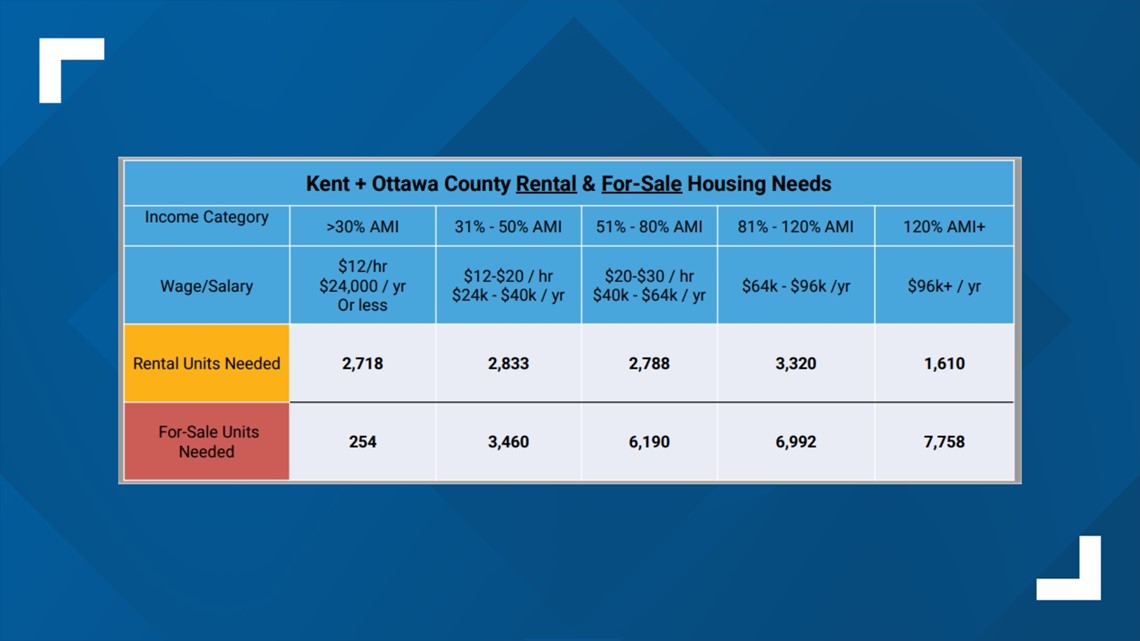

In the next three years, Kent and Ottawa counties combined will need just shy of an estimated 40,000 new homes and rental units just to satisfy demand, the equivalent of building more than 200 new units every week.

“The stress levels on everybody, the consumer, the agent, the closing service providers, everybody is through the roof,” said housing expert Mark Johnson, president of JPAR Real Estate.

What’s worse, the trend may not fade in the near future.

“I call it a trend, not a fad…the trend is there are 71 million millennials…and they’re buying homes,” Johnson explained.

Johnson continued that aging Baby Boomers, who are retiring, on average, several years later are retaining family homes.

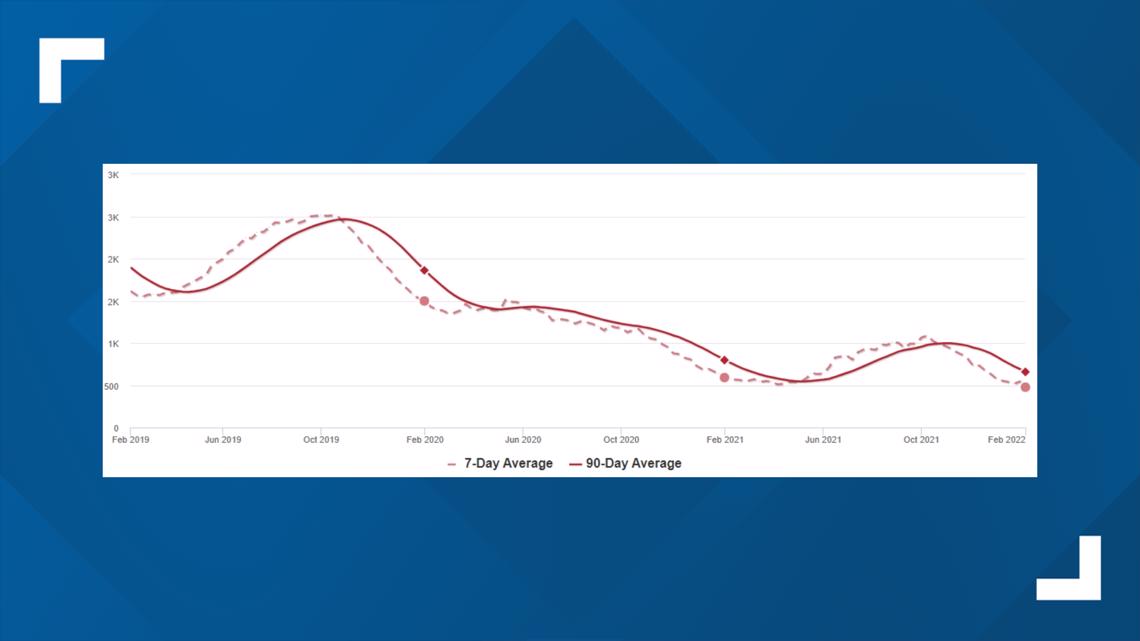

Underscoring the trend Johnson described, data compiled by his brokerage showed the home supply in Grand Rapids falling from more than 1,600 several years ago to just over 400 as of this week.

Basement-level inventories nationally pushed the average rent an eye-watering 14% higher over 2020.

In the nation’s 50 largest cities, the increase was even more pronounced.

Austin, Texas topped 40%.

“Rents have increased to 25% of income on average, making the buy decision even more compelling,” Johnson said. “The challenge is not enough houses for sale.”

Compounding the effect of surging price points, consumers now also have to do more with less.

In a study put out by AmeriLife and OnePoll, roughly seven in 10 Americans claimed they were living paycheck to paycheck as wages failed to keep pace with inflation.

“We haven't seen the dramatic price spikes that we're seeing in cities like Austin…and some other high tech, high cost markets,” Kilpatrick explained. “But we're on our way there.”

Until demand stabilizes or supply increases, the pressure will likely hold for the time being.

On the regulatory side, experts acknowledge there’s no silver bullet.

“We've really got to start taking a regional approach to this…how do we work on both housing supply and transportation simultaneously,” Kilpatrick said. “Definitely no one-size-fits-all solution.”

Related video:

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter. Subscribe to our YouTube channel.