GRAND RAPIDS, Mich. — As we mark Severe Weather Awareness Week, 13 is ON YOUR SIDE helping to make sure you’re prepared. That includes making sure your insurance coverage truly has you covered when severe weather strikes. This Money Guide has some tips and helpful reminders to keep in mind.

Heather Paul is a spokesperson and public relations specialist with State Farm. She said, “We know this is the time when everything’s going to change. One day it’s winter. The next day it’s thunderstorms and hail.”

She recommends your first step should be checking “to see what type of coverage you have.”

“Now’s a good time to maybe clean your garage up so that you can get your vehicle in. There’s a lot of damage that can result from hail,” Paul added.

In 2022, State Farm paid $25.5 million, just in Michigan, for hail claims alone involving cars and for homes.

“Hail damage causes a significant amount in everything from broken windshields to dents in your car and then certainly damage to roofs and shingles and your siding,” said Paul.

Severe weather can often lead to power outages. Paul says there are areas of coverage for this you may not have considered.

“You may have insurance coverage for food spoilage if you have a power outage. It could be as simple as taking an inventory and photos of what you have in your freezer to be able to document what you’ve got in your freezer,” said Paul.

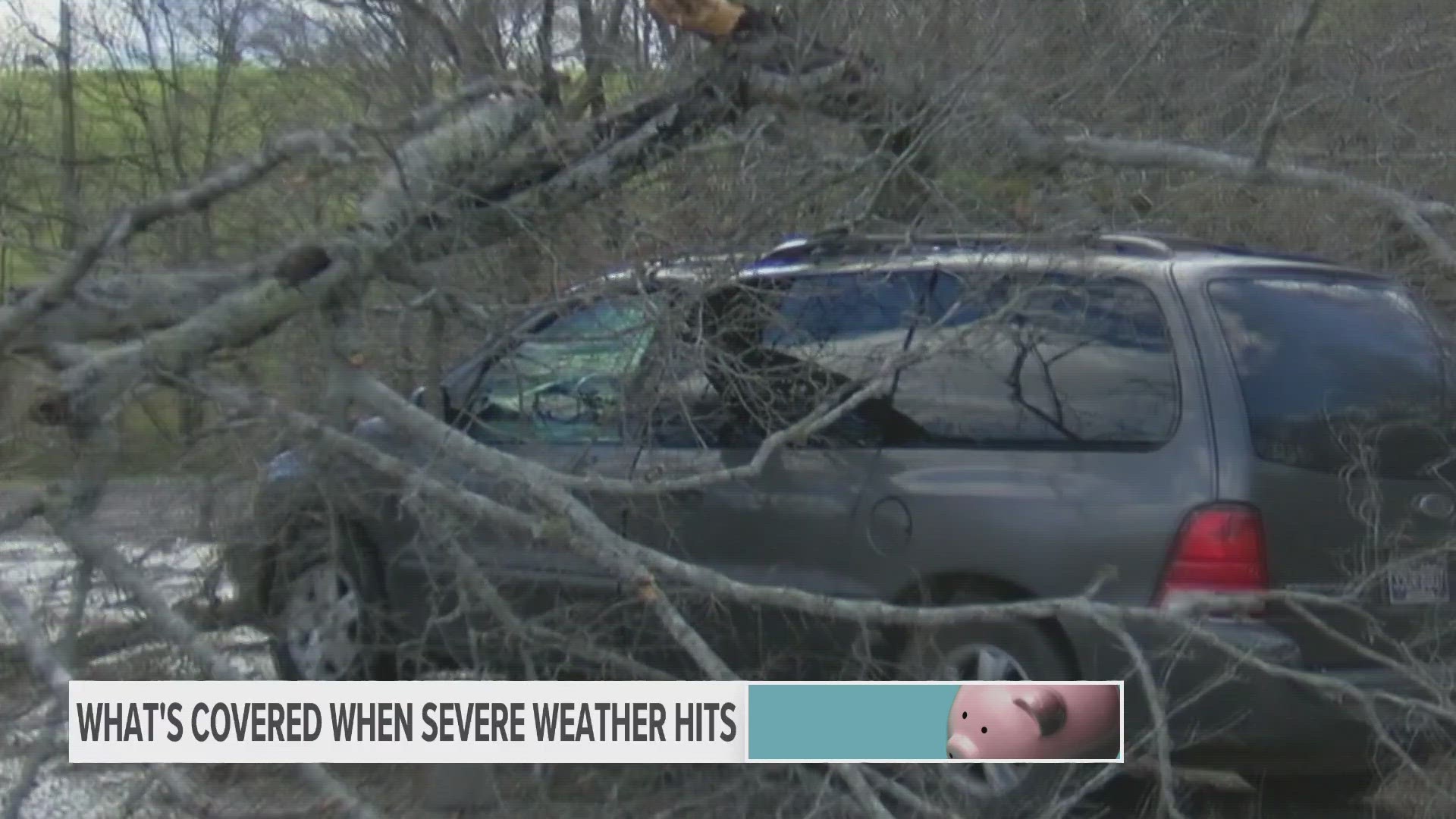

When it comes to downed trees, she said, “For insurance purposes, it doesn’t matter if the tree was from your neighbor’s or from your own home. It’s going to be covered. An additional part of your policy you may not be aware of is: Am I responsible as the homeowner for covering the cost of cutting up that tree and removing it? Or is it something that my insurance company will help to cover that cost? For some insurance companies, it may be an additional insurance policy you need to add on.”

Regardless, before you have any work done for repairs, “talk to your insurance company and your claims adjustor before you sign any contracts with a contractor to fix it. Unfortunately, there’s a lot of contractor fraud that takes place,” said Paul.

One area your homeowners insurance likely doesn’t cover is flooding.

“Flood coverage is under the National Flood Insurance Program. So, it’s not something that is covered under your standard homeowner policy. If you live in flood zone or close to a body of water, you need to get flood insurance through an FIP. You can’t get that through your regular insurance company. So, you need to go through the federal government in order to get that,” said Paul.

Paul admits that these can be complicated and confusing conversations “for the regular person that doesn’t understand what is covered. So, all it takes is a real, simple conversation with you insurance company to make sure you understand.”

She also recommends making sure you’re familiar with your deductible. This means knowing how much money you’ll need to pay out-of-pocket before the insurance kicks in.

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter. Subscribe to our YouTube channel.