LANSING, Mich. — Crash survivors, their families, and the Michigan HomeCare & Hospice Association (MHHA) rallied once again in Lansing, calling for a legislative fix to auto no fault reform.

This comes after the Michigan Court of Appeals ruled in August the state's 2019 no-fault insurance reform does not apply retroactively.

The judges said it was not the legislature's intention to change care promised to those injured prior to 2019. Even if it were, that would violate the contract clause in the state's constitution.

It's a step in the right direction, advocates for survivors say, but change needs to happen permanently within the legislature.

"We're not asking for the entire reform to be thrown away," said Theresa Ruedisueli, regional director for Arcadia Home Care & Staffing, "That's a total misnomer. We're just asking for parts of it to be adjusted, so we can sustain homecare to these people who bought the policy. They deserve the care."

Supporters of auto no-fault reform say it saves drivers money on car insurance, and highlight the $400 refund checks Michigan drivers received this year.

However, crash survivors and supporters say there were unintended consequences. A major one was home care reimbursement rates cut by 45%.

The reform instituted a fee schedule and a 56 hour cap on in home care hours for treatment of catastrophic accident victims. The measures were intended to curb overcharging and price gouging. Injury care providers have been forced to close their doors as money from no-fault insurance dried up, and survivors who depended on care were left in the dark.

Ruedisueli said prior to the reform, they had 30 no-fault clients. In the last year, they have had to discharge 15 of them.

"It really is a heart wrenching decision to have to tell a client and their family that we're no longer able to care for them due to the fact that we're not getting reimbursed at a rate that we can sustain our ongoing business," said Ruedisueli, "We get reimbursed less than what we have to pay our caregivers that."

Michigan's Public Health Institute released results of a new study last week. It found 78% of respondents reported a loss of services. More than a third reported an impact on rehabilitation, increased medical needs, or increased behavioral needs.

10% said they were hospitalized as a direct result to loss of service brought on by no fault reform. 6 deaths were reported.

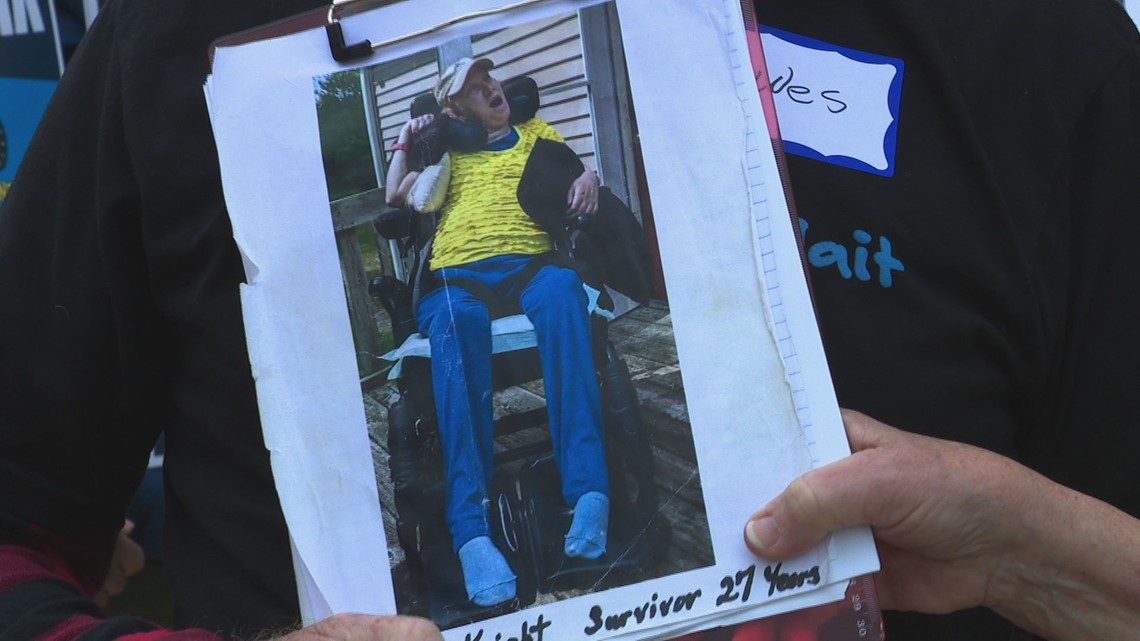

Wesley and Sheryl Bush were among the crowd in Lansing Wednesday. Their daughter, Angela, is a crash survivor. She is now a quadriplegic, and requires around the clock home care.

"She planned ahead, bought insurance, had it for 27 years," said Sheryl, "They pulled the rug out from a helpless person. They should be ashamed of themselves."

Sheryl said since the reform went into place last year, her daughter's caregivers' wages have been cut nearly in half. Medical supplies previously covered by insurance are no longer.

"I have stacks and stacks and stacks of bills that are unpaid," said Sheryl.

After the Court of Appeals decision in August, the Insurance Alliance of Michigan announced plans to appeal Thursday's ruling, saying in a statement:

“The medical fee schedule established by these bipartisan auto no-fault reforms is absolutely critical because it reins in overcharging by medical providers and brings fairness, common sense and transparency to the costs of medical care. Reforms have lowered costs and saved Michiganders more than $5 billion over the past three years through reductions in the Michigan Catastrophic Claims Association fees and a $400 per-vehicle refund, in addition to the mandatory reductions in the personal injury protection (PIP) portion of insurance policies. While today’s court ruling is a setback for drivers, Michiganders have come too far to turn back to the days of unaffordable auto insurance, fraud and rampant medical overcharging."

According to the MHHA, the decision only affects the Michigan Catastrophic Claims Association (MCCA)'s yearly fee. The organization says that is about three to five percent of its overall policy.

"According to the MCCA, the average yearly premium for unlimited personal injury protection in Michigan is now about $2,400," said Barry Cargill, President of MHHA in a press release, "With 7.5 million drivers, insurance brings in $18 billion per year. Fixing the 45% cut will cost about $250 million per year, 1.38 percent of premiums."

Multiple bills have been introduced to both the state House and Senate to fix portions of the no fault reform. All have stalled in Lansing.

In March, House Speaker Jason Wentworth said "it's time to move on," about proposals to fix the 2019 law that brought down auto insurance payments. It came as $400 rebate checks made their way into Michiganders' mailboxes.

RELATED VIDEO: One year after Michigan's auto no fault went into effect, survivors struggling

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter. Subscribe to our YouTube channel.