According to 2016 Census data, the average household income in Michigan is slightly above $50,000 with 2.51 people per home. We used those figures to determine how the new GOP tax bill will directly affect West Michigan families.

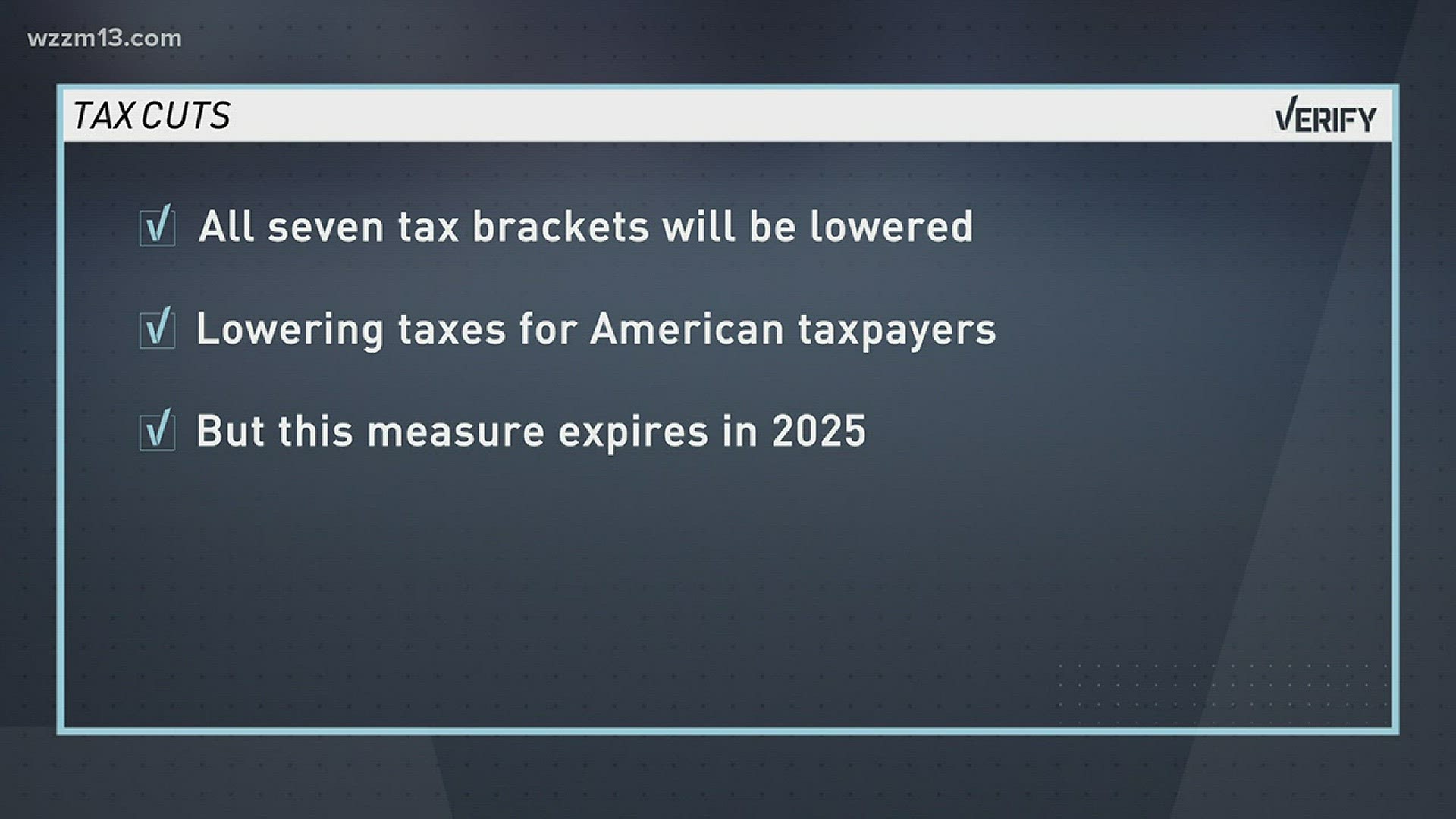

The short answer: Yes, at least until the year 2025 (when the cuts expire) -- taxpayers can expect to see minor a tax break.

But taxpayers won't really see those benefits until they receive their tax return in 2018. The only way to reap those benefits sooner is to adjust the amount withheld from your paycheck to match the new taxation amount.

Phil Mitchell, president of Kroon & Mitchell, sat down with us to explain some of the key takeaways of the tax bill:

What is the average person looking at?

"The average person is going to see a small tax cut. There are a lot of things happening - and that's just a small portion of it. Nothing substantial - but there will be a small tax cut."

So, why do those tax cuts expire in 2025?

"They had to expire those cuts in 2025 to balance the budget from other cuts made in this tax bill."

"But you won't see those benefits until 2018, when the plan begins. We still have a while for all these benefits to flow through. Like a person won't see their tax cut benefits until their tax return in 2018 - unless, you adjust the amount withheld from your paycheck to match the new taxation amount. Otherwise, you will just likely see a higher tax refund."

What does the doubling of the standard deduction mean for average taxpayers?

"You have a choice either standard or itemized deduction. So, you may itemize your expenses but end up with very little benefit beyond what you would see by using standard deduction. And with the new bill doubling the standard deduction -- it just makes it a simpler process. There will be less elements required to file your taxes.

This means that the standard deduction will now be your starting point - but this applies only to the average person who doesn't own a business or have a lot of complexities."

The only permanent tax cut in the bill is the one that cuts taxes for corporations from 35 percent to 21 percent. Mitchell said the question now is how corporations will choose to spend that extra revenue. The idea is corporations will put that money back into the economy and in turn generate more money Americans, but at this point, no one person can predict how exactly this will play out.

►Make it easy to keep up to date with more stories like this. Download the WZZM 13 app now.

Have a news tip? Email news@wzzm13.com, visit our Facebook page or Twitter.