GRAND RAPIDS, Mich — There are some changes to the Child Tax Credit parents should know before filing their taxes.

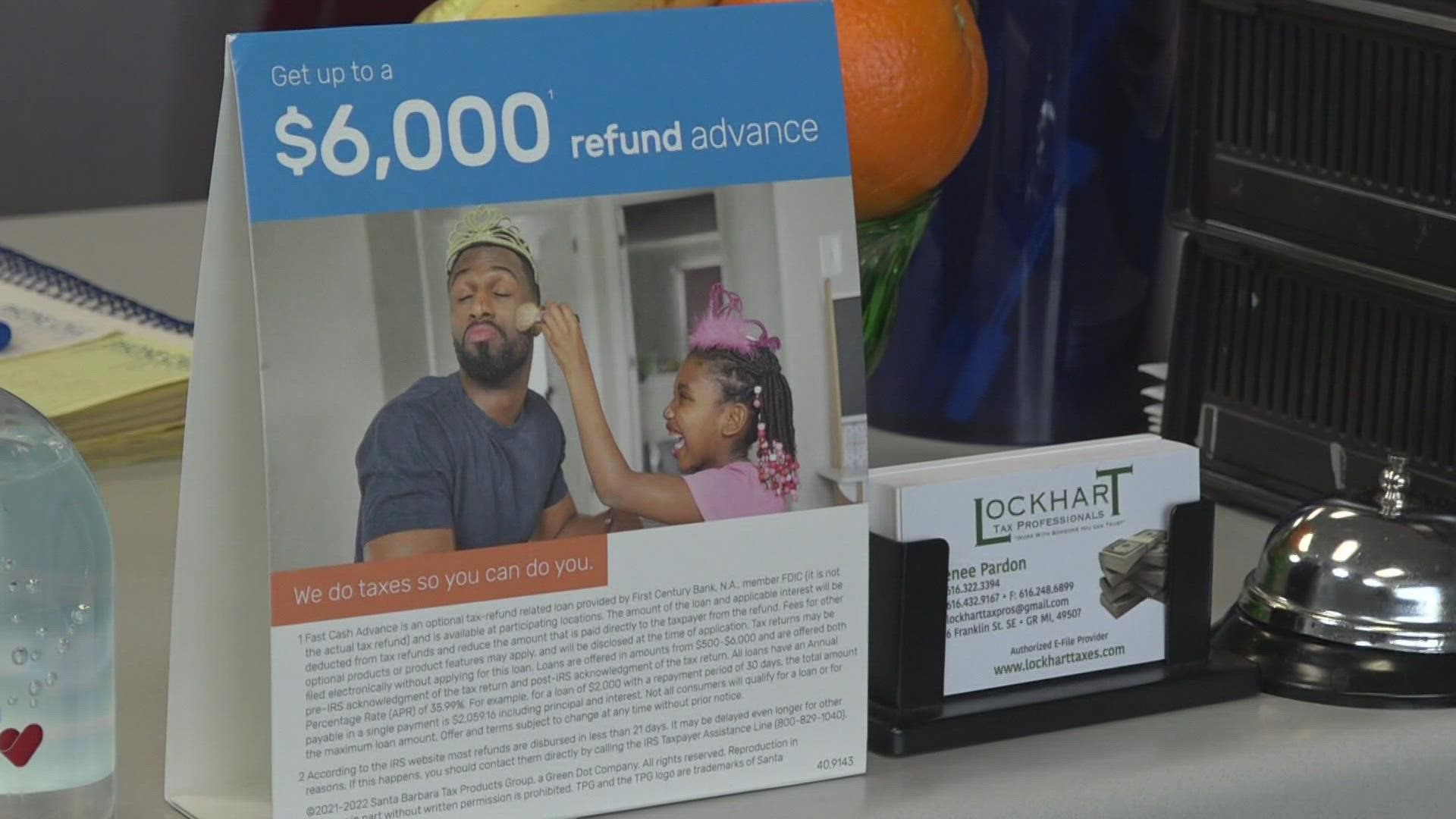

We sat down with Renee Pardon with Lockhart Tax Professionals in Grand Rapids to explain the change.

In 2021, the credit per child under six increased from $2,000 to $3,600. It is now $3,000 for children six to 17.

Plus, this credit is now fully refundable.

"So, that is something that is going to be actual take home money in your hand," said Pardon. "So, someone with three qualifying children could get a potential up to $10,800 for those children on the return, even if they didn't work."

Then, in July of 2021, eligible parents began receiving advanced payments. They were automatically enrolled if they had 2019 or 2020 tax returns filed with the IRS.

"So, that amount that they received will be deducted from their tax refund when they file their 2021 return," said Pardon.

Pardon said when parents file their taxes, they will need to include form 64-19, which is being sent out this month by the IRS.

Income limits for the Child Tax Credit are $75,000 for single or married parents filing individually, $112,500 for head of household, and $150,000 for parents filing jointly.

The increase to the child tax credit was introduced to get more money into the hands of families. Pardon said this will help families across the board.

"Things are constantly going up, as far as the cost of living," said Pardon. "So, it's going to change, you the every day struggles that some families may have. So, I'm excited for the for the community in the lower and middle class families that are going to benefit off of this credit,"

Pardon said she is encouraging people who have previously not filed to do so this year. She said if anyone has specific questions, to all them at (616) 248-6899.

RELATED VIDEO: What happens if the monthly child tax credit isn't extended to 2022?

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter. Subscribe to our YouTube channel.