LANSING, Mich. — Michigan's Legislature on Friday passed a landmark bill that would cut the country's highest auto insurance premiums by letting drivers forego a one-of-a-kind requirement to buy unlimited medical coverage for crash injuries.

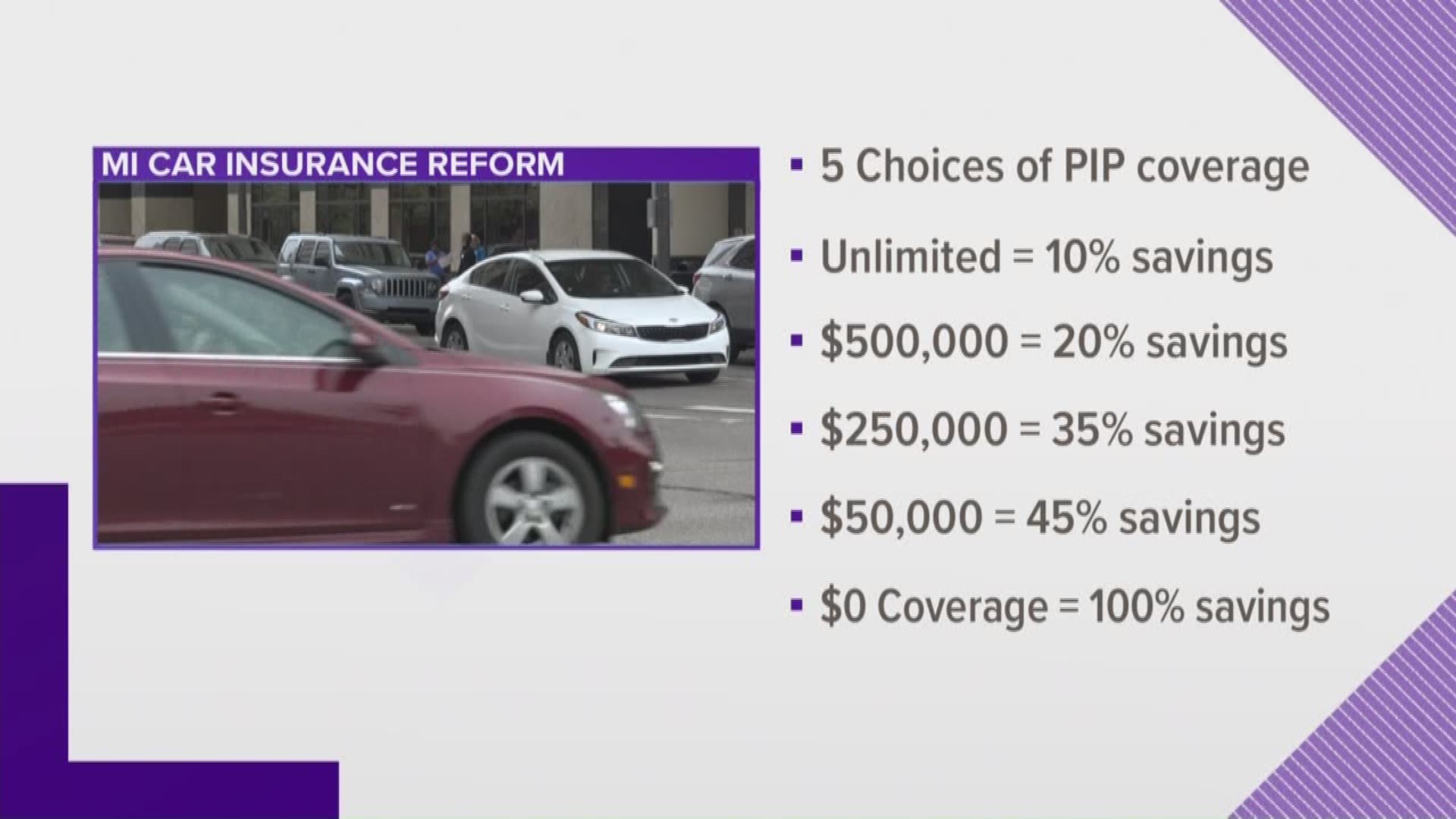

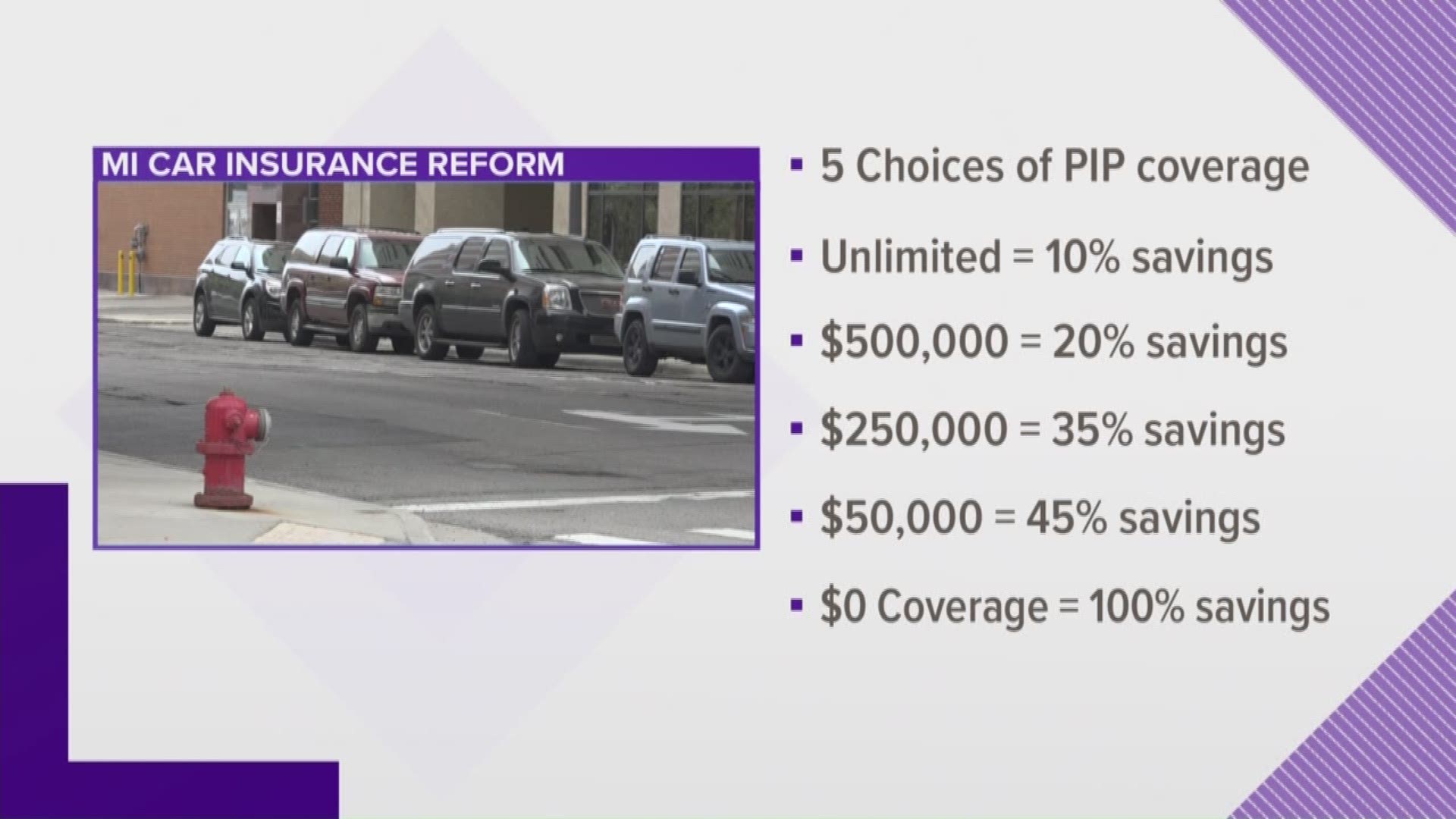

The voting followed the announcement of an agreement between Republican legislative leaders and Democratic Gov. Gretchen Whitmer. She said the legislation would guarantee rate reductions for every motorist and offer choice among personal injury protection, or PIP, levels. PIP, on average, makes up half of car premiums.

The measure — approved 94-15 by the House and 34-4 by the Senate — also would prohibit the use of several non-driving factors in setting rates and scale back reimbursements for health providers that treat accident victims to 190% to 230% of what Medicare pays. Unlike several other no-fault insurance states, Michigan does not have a fee schedule for care covered by auto insurers. They pay much more for the same services than is paid by employer plans or government insurance such as Medicare or Medicaid.

A driver choosing to stick with unlimited coverage would see a 10% PIP reduction. Someone who fully opted out would get a 100% cut, if they have health insurance, and potentially also avoid paying much of a $220 annual per-vehicle fee that reimburses car insurers when severely injured motorists' expenses exceed a certain amount.

People on Medicaid would have to get at least $50,000 in benefits and would pay 45% less. People picking one of two other options — $250,000 or $500,000 of coverage — would see a 35% or 20% reduction.

The rollback in PIP rates would start in July 2020 and last for eight years. It could amount to $120 to $1,200 in savings for someone paying $2,400 annually per car, assuming the PIP fee accounts for half their bill, according to GOP projections.

"This is a win for the 7 million drivers across the state of Michigan who have been asking us for years to step up and provide a real solution to our broken car insurance system," said House Speaker Lee Chatfield, a Levering Republican, who called it a "very historic" day.

The average premium in Michigan — which is $2,693, according to the most recent report from The Zebra, an insurance comparison website — is 83% higher than the national average of $1,470. Detroit's premium on average is $5,464, far surpassing any other U.S. city.

A University of Michigan study found that car insurance on average is "unaffordable" in 97% of Michigan's ZIP codes, based on the federal government deeming auto insurance as unaffordable if premiums exceed 2% of a ZIP code's median household income.

Detroit Mayor Mike Duggan, who filed a lawsuit last year asking that the 1973 no-fault law be declared unconstitutional for failing to provide "fair and equitable" insurance rates, said the bipartisan agreement is "outstanding" and "will cut rates for Michigan drivers significantly."

Despite the deal, some Democrats voted no.

Rep. Sherry Gay-Dagnogo of Detroit said proposed bans on the use of credit scores and ZIP codes as rating factors would not go far enough because insurers could still base premiums by territory and use drivers' credit-related information. She said Whitmer "worked to do the best that she could do," but should veto the bill.

"In order for us to get to its best current form would be to remove territorial rating. That's the true root cause of redlining," she said. "How we treat our citizens across the state fairly — that's been her commitment on the trail, that's been mine, that's been my colleagues' — I think for us to deviate from that today says something about our value statement."

But another Democrat from Detroit, Rep. Karen Whitsett, said her constituents pay the most expensive premiums in the U.S.

"This day means the world to me and my district because finally — finally — they can get the relief that they need and so desperately deserve," she said.

The compromise came the same week that billionaire businessman Dan Gilbert took initial steps toward launching a ballot drive as a "failsafe" in case the Legislature and governor did not enact legislation. The move would have enabled GOP lawmakers to overhaul the insurance law without having to worry about a gubernatorial veto.

RELATED VIDEO:

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter.