LANSING, Mich. — Michigan Governor Gretchen Whitmer signed into law Tuesday a key tax bill, seeking to fulfill two major promises she made when she announced her Lowering MI Costs Plan in January.

Joined Senate Majority Leader Winnie Brinks, Speaker of the House Joe Tate and other members of the state legislature to sign the into law.

One of those key priorities in the law centers around the state’s Earned Income Tax Credit that qualifies people of certain income levels. The increase quintuples the current credit from 6% of the federal credit to 30%, meaning if a person was eligible to take $150 off from being taxed through the EITC, which was the average in the state in 2019, they would now be eligible to have $750 of their income not taxed.

"We're talking about a boost," Michigan League for Public Policy President Monique Stanton said. "On average, the family that's receiving the the new revised, updated earning, earning income tax credit, is gonna get about $3,000 back on average, and that's between the federal credit that you get that's in existence, and the increase in the Michigan credit."

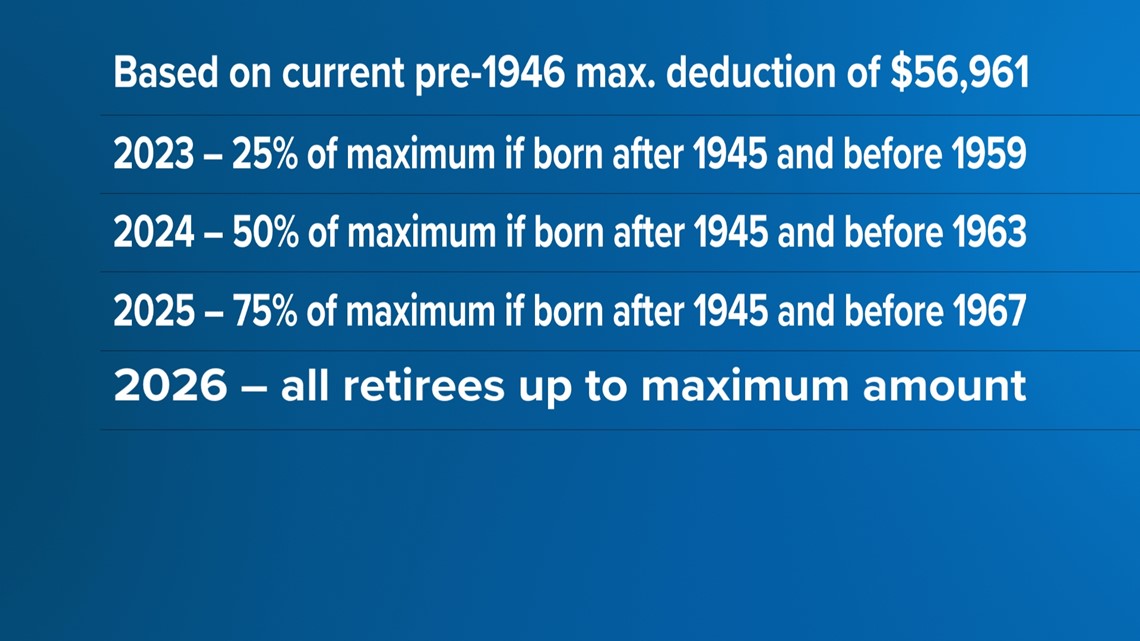

The second policy priority included in the law jumpstarts a 4-year phase-out of taxes on retirement income for both public and private pensions. The amount of money and those eligible based on their birth year would expand each tax year until 2026, when all retirees would be eligible and could deduct from having to pay taxes on social security benefits and up to almost $57,000 of pension income.

“Right now, families are facing the pinch and having tough conversations about how to make ends meet,” Gov. Whitmer said. “Today, I am proud to sign a $1 billion tax cut for seniors and working families. Getting this done will help people pay the bills, put food on the table, and afford essentials like groceries and school supplies. It will ensure seniors can keep more of what they’ve earned over a lifetime of hard work and put money back in the pockets of 700,000 working families. I will continue to work with our legislative partners to build on this progress, grow our economy, and lower costs for every Michigander.”

While some advocates have questioned the gradual phase-out as opposed to a more immediate approach for the 2023 tax year, proponents of the law on Tuesday defended their decision.

"The repeal of the retirement tax, rather, is scaled in because there are a lot of different components of it and it allows us to unwind it in a way that makes it work and also give relief to the most amount of people," said Sen. Kirsten McDonald Rivet.

Retiree advocates at the signing said even a phased-in approach will help their members.

"The relief that we’re getting right now will help our retirees immediately and it will continue to grow that relief over time which is incredible," Michigan Education Association President Paula Herbart said. "Originally, [retirees] had it pulled immediately out from under them. That’s not right. So even a phased-in approach is exactly what retirees need to get themselves back on track."

The phase-out of taxes on retirement income will start by applying to the 2023 tax year, meaning the earliest any retirees will start to see the relief will be when paying taxes that are due in April 2024.

Some state Republican leadership celebrated the tax cut but also called out Whitmer's administration for not acting sooner.

“Gov. Whitmer vetoed my plan to provide Michiganders broad tax relief last year,” House Republican Leader Matt Hall, R-Richland Township said. “Between the automatic income tax rollback for everyone and the new law providing relief for seniors and working families, we are now finally passing the relief that could have been benefiting taxpayers already."

“Life will be more affordable for Michiganders thanks to tax relief secured by House Republicans,” Hall said. “We made tax savings our top priority to help the people of Michigan overcome the rising cost of living, and we’ve now secured two relief measures while protecting another tax cut from Gov. Whitmer’s misguided plot to shut it down and hike taxes. Although the governor and Democrats wanted to distribute relief to seniors based on how they earned their retirement income, Republicans advocated for all Michigan seniors and ensured that relief is fair for every retired Michigander."

Previous hopes for $180 direct checks the governor had mentioned in weeks prior were dropped from the bill after it failed to get the two-thirds support it needed from the legislature to take immediate effect.

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter. Subscribe to our YouTube channel.