MICHIGAN, USA — As prices at the pump remain sky high, some wonder whether electric vehicle owners are paying their fair share of taxes used to maintain public roads.

A viewer asked the 13 On Your Side Verify Team to look into it.

THE QUESTION:

Steven from Grand Rapids asked “Do EV's pay any road tax on the electricity they charge their EV battery with to help maintain the roads we all share? If they don't, when will they and wont that increase the cost?”

ANSWER:

No, there is no dedicated tax that applies to the drivers of electric vehicles in the same way the fuel tax applies to the drivers of conventional vehicles, though policy-makers are eyeing alternatives. Additionally, from the state’s standpoint, additional fee structures have been installed to bridge the resulting fiscal gap. Electric vehicle owners may also be assessed a usage fee by their utility provider in an effort to maintain the grid.

SOURCES:

- The Michigan Secretary of State website

- The Infrastructure Investment and Jobs Act

- Jonathan Brignall-Assistant Professor of Accounting, Grand Valley State University

- Soren Anderson, Ph.D.-Associate Professor of Economics, Michigan State University

WHAT WE FOUND:

“Electric vehicle owners, because they don't use gasoline in their cars, they don't pay that specific gasoline tax at the pump,” Anderson said.

In the process, dodging the extra respective 27.2 and 18.4-cents/gallon paid-out by conventional drivers in state and federal fuel excise taxes.

“The gas tax at the federal level is really the bulk of the funding for the Highway Trust Fund,” Brignall indicated. “It sort of makes the tax structure obsolete.”

If the average driver travels approximately 13,000 miles over the course of a year, they would wind up filling the state’s tank with around $140 in taxes over the same time period.

So, do more EVs on the road mean Michigan loses out on that chunk of change?

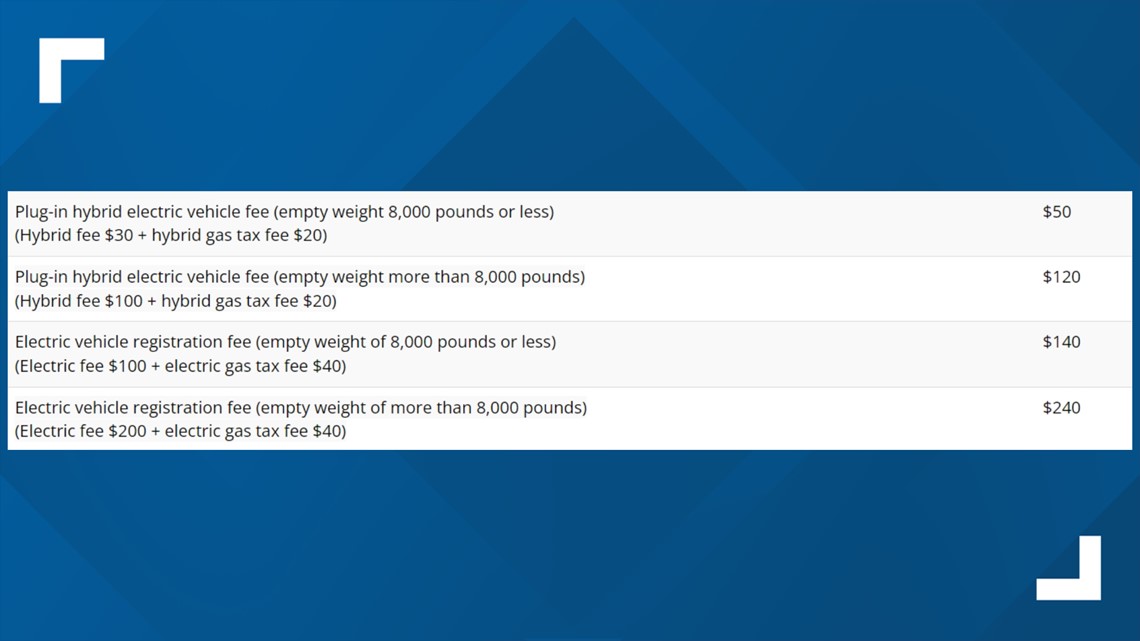

“Michigan… has recognized the potential unfairness,” Anderson related. “Michigan actually has a special kind of registration fee increment for electric vehicles.”

The Secretary of State’s registration fee schedule refers to the fee assessed to the owners of EVs and hybrids as an electric gas tax.

At $140, the extra fees roughly equate to the amount the average conventional driver shells out in actual state taxes.

Yet, zooming out to the big, overarching national picture, Brignall says this: “Nothing like that has been enacted."

Lawmakers have floated several possible solutions. A voluntary pilot program contained within the infrastructure act will, over the course of the next four years, study a theoretical per mile tax.

Given the time frame, experts suggest it’s too early to gauge the impact of such a tax, the rate itself, in addition to how it would be implemented.

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter. Subscribe to our YouTube channel.