MUSKEGON, Mich. — As election season hits its stride, several candidates for Michigan governor have rallies or appearances planned inside area churches.

Those like Republican Ryan Kelley was scheduled to appear in the Detroit Metro area this weekend.

The event prompted a viewer to ask whether those candidates may be in violation of the separation of church and state.

The 13 ON YOUR SIDE Verify Team found the answer.

THE QUESTION:

“Are political candidates who hold rallies or appearances inside churches in violation of the separation of church and state?”

“Are churches jeopardizing their tax-exempt status in allowing such appearances?”

SOURCES:

THE RESULT:

In answer to the first question, we were able to Verify, no, political candidates who hold rallies or other appearances inside religious facilities aren’t in violation of the establishment clause.

The second question received a yes: churches and other non-profits which endorse specific candidates do risk their tax-exempt status, though experts indicated there were a number of notable gray areas. They also suggested the IRS rarely investigated such violations.

WHAT WE FOUND:

“There's no violation of the First Amendment,” Lund related via phone Friday.

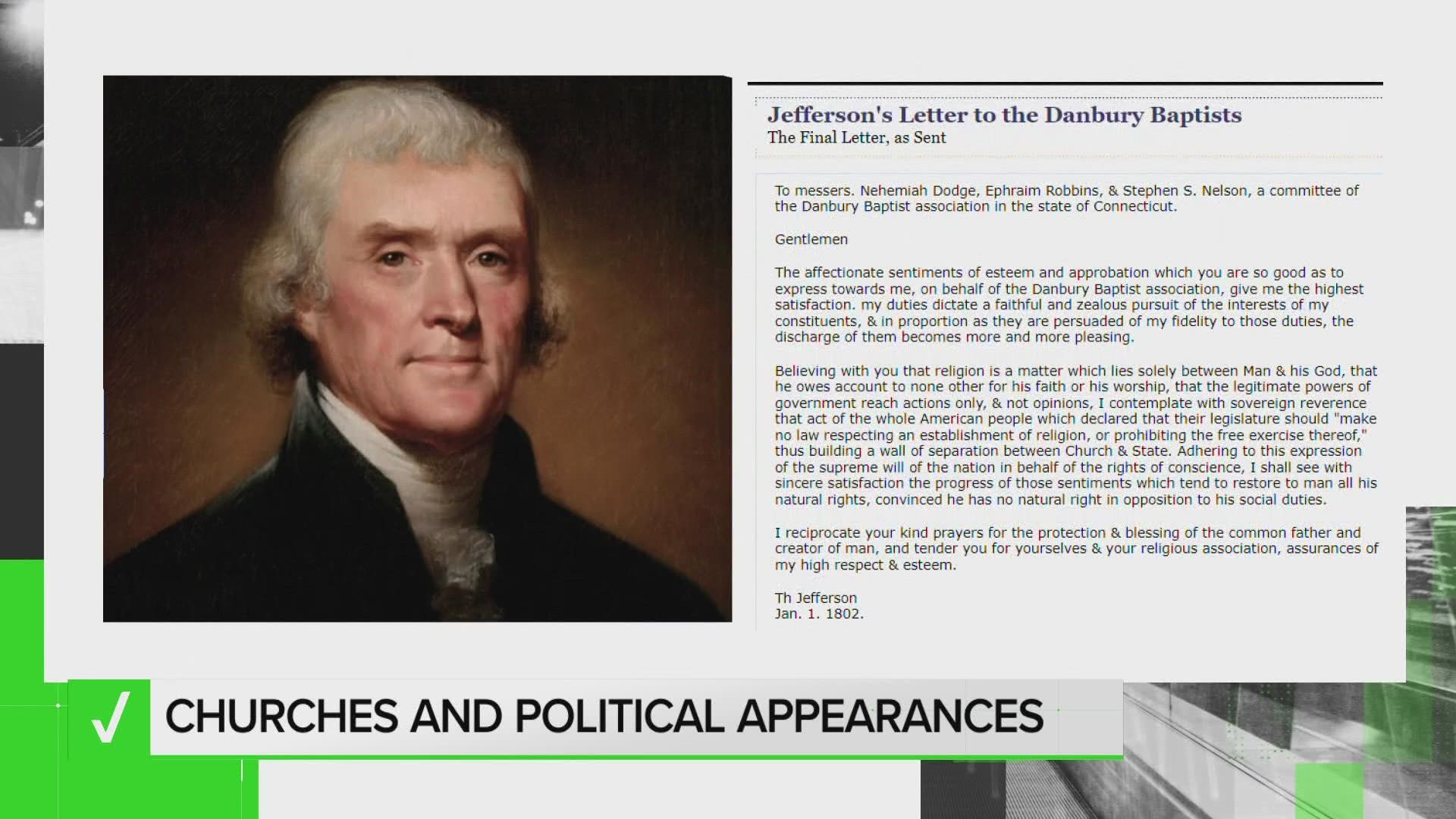

Thomas Jefferson was among the first to coin the phrase ‘separation of church and state’ in a letter he penned to the Danbury Baptist Association in 1802.

The principle’s actual legal basis stems from the first clause of the Bill of Rights -- what’s known as the Establishment Clause – which reads “Congress shall make no law respecting an establishment of religion.”

Cornell University says the clause also “prohibits government actions that unduly favor one religion over another.”

“It's a basic rule of the Establishment Clause that the government can't… take positions on religious questions,” Lund said.

As for the second question, churches and many other non-profits qualify for 501(C(3) status, a special designation given by the IRS which exempts those organizations from paying federal taxes.

“Certainly, churches and nonprofit organizations can take positions on matters of public policy, they can be pro-life or pro-choice, they can support gay rights or oppose gay rights, but they're not supposed to take a position on whether Candidate A or Candidate B should be elected to public office,” Lund explained. “In practice, the IRS has the possibility of stripping organization of their tax exempt status.”

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter. Subscribe to our YouTube channel.