WASHINGTON, D.C., USA — As the war in Ukraine rages on and western nations continue to sanction Russia, the price of oil and gas seems less and less sure by the day. Sky high prices at the pump are no doubt partly caused by countries turning away from Russian oil, but if a limited amount of US oil comes from Russia, why are gas prices soaring?

THE QUESTION

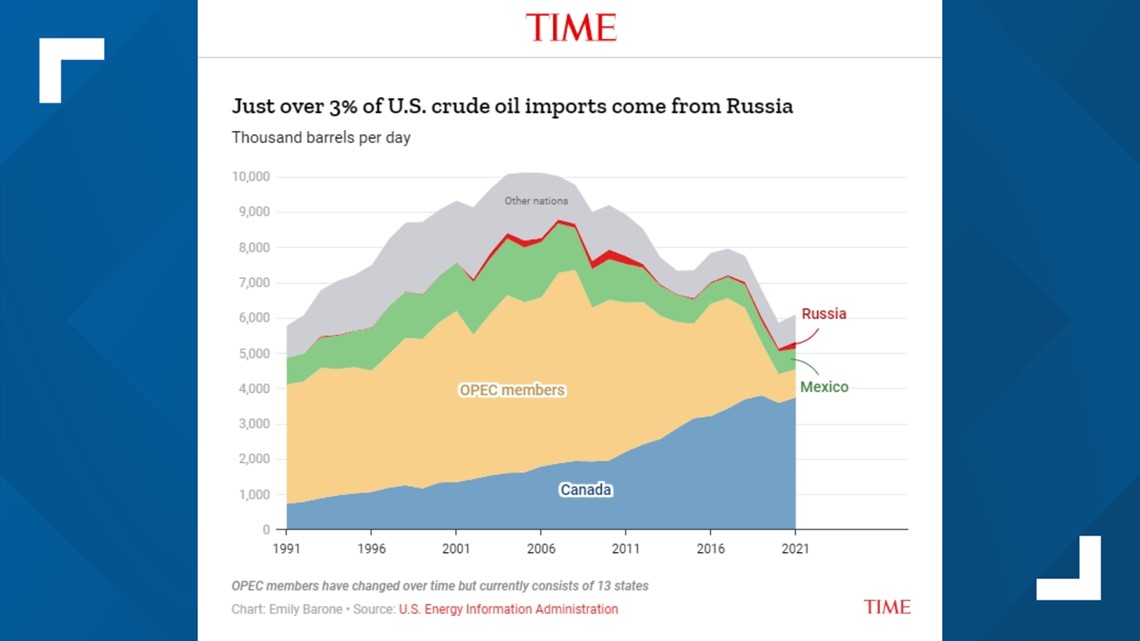

Dick in Muskegon asks: "The latest issue of Time Magazine indicated that the U.S. gets 3% of its oil from Russia. If so, why did the price of gasoline rise so high?"

This is the graph Dick was citing, which comes from this article by Time Magazine.

OUR SOURCES

- The United States Energy Information Administration

- Dr. Matthew Ross, a former Sonoco project engineer and professor at Western Michigan University

- Jason Geer, President and CEO of the Michigan Oil and Gas Association

THE ANSWER

The claim that the US gets 3% of its crude oil from Russia is factual. Dr. Ross mentioned that number in our interview, and that's backed up by a March 22 report by the EIA.

But that 3% is not the whole picture, and Dr. Ross, again backed up by data from the EIA, says it's another import that shows why the cost at the pump is soaring.

"The US does import about 3% of the crude oil from Russia," Ross said. "But about a fifth of our imports come from Russia in the whole petroleum market, and that includes crude oil, gasoline, diesel."

Crude oil refers to unrefined petroleum — very different to the stuff that powers our cars and trucks. Gas and diesel coming from Russia made up 20% of US petroleum imports last year. When sanctions came down and those imports stopped, supply plummeted just as demand was increasing again.

"We’re coming out of the pandemic and so demand is just going crazy," Geer said. "You had almost two years of inactivity on oil and gas so you don’t have that cushion of supply that you have in a routine year."

Geer says during the pandemic, US oil refineries and pumps shut down or stopped producing due to labor and demand reductions. As restrictions around the nation ended, the refineries, pumps and wells were not ready to rebound just yet. He says that meant the US was at a tough spot with limited reserves that would have otherwise cushioned the blow of cutting off the Kremlin.

"Crude oil is not a domestic priced product, it’s globally priced, so prices depend on supply and demand," Geer said.

It's not just the US saying no to Russia, it's much of Europe and other nations who are even more dependent. With even more nations competing for a smaller supply, the price is certain to rise.

Geer and Ross both say OPEC nations have not worked to lessen the price, and because countries are so oil dependent, they essentially have no choice but to pay what the market demands, which means even though the US is only importing 3% of its crude oil from Russia, the other factors of the global market mean filling up stateside may be pricy for a while to come.

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter. Subscribe to our YouTube channel.